Move over, Goldman Sachs Group Inc. Germany’s savings banks are trying to become an unusual source of funding for private equity deals, just like the big banks on Wall Street. Lenders like Kreissparkasse Biberach near Lake Constance and Sparkasse KolnBonn in the Rhineland are increasing their bets on small and medium-sized leveraged buyouts. This helps fill a funding gap left by larger international peers who have pulled out of the market.

It shows that Germany’s regional banks, which used to focus on helping families and small businesses, are now using riskier, higher-return strategies. Last year, when there was a chance of a recession, it was hard to get credit and make deals, but the Sparkassen kept going.

Kreissparkasse Biberach board member Kurt Hardt said of the bank’s lending for buyouts in 2022, “We did not put the brakes on.” “LBO financing lets us expand our business in different ways. Also, the margins are good.”

But the moves have made people worry that these lenders are taking unnecessary risks and going beyond their jobs to give credit to the regional economy. This could put their peers and governments at risk of losing money, just like the bigger Landesbanks did after the 2008 financial crisis. The European Central Bank recently told companies like Deutsche Bank AG that they need more capital for leveraged lending. This shows that regulators are still keeping an eye on the practice.

Bigger Bets

Kreissparkasse Biberach is in its namesake town, a quiet place with a big Gothic church on the market square. Last year, it gave out 10 LBO loans, two more than in 2021, which was the busiest year ever for private equity deals. Chairman Martin Bücher said that the company is willing to raise the size of its LBO book to €500 million ($531 million). “We still have some wiggle room that we’re ready to use if the chance comes up.”

Kreissparkasse Biberach and other smaller banks have been picking up the business that bigger banks that have cut back on their leveraged financing desks have left behind. Michael Josenhans, a partner at the law firm Freshfields Bruckhaus Deringer LLP, says that they have even hired some of the finance bankers who lost their jobs during restructurings to help build their own teams.

Josenhans Said-

“Savings banks have been active in LBO financing for a number of years, but have become more visible in recent months as other debt providers are scaling back”

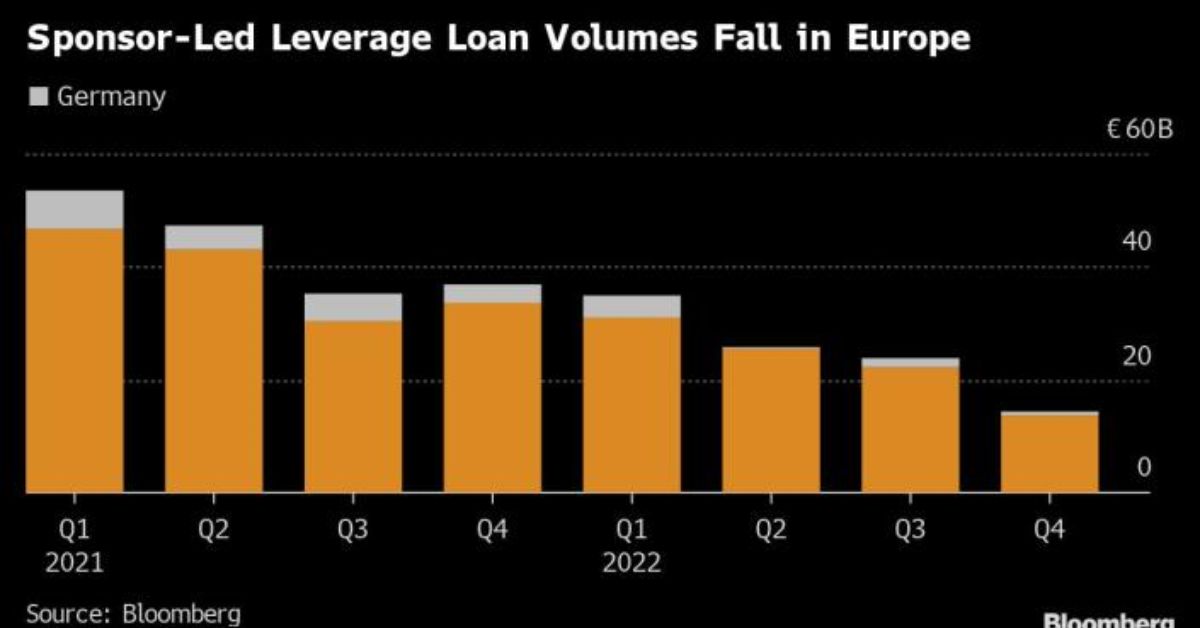

This kept at least a small way to get money open in 2022, when Bloomberg data show that the value of loans used to back private equity deals in Germany dropped by 65% to €6.6 billion. The LBO businesses of savings banks helped companies like DBV Baumaschinen- & Baugeratevertriebs GmbH, which sells containers, be bought by B plus L Group, which is backed by private equity, and Duvenbeck Group, which does logistics, be bought by Waterland Private Equity.

LBO lending gave Germany’s savings banks a way to make more money when ultra-low interest rates made it hard for them to make a lot of money from retail loans. It also gave private equity firms that like to buy businesses a new customer base and a way to keep old ties with local businesses they buy.

“Nearly half of the family-owned businesses in the Cologne-Bonn region will undergo a generational change in the next few years,” said Uwe Borges, head of corporate banking at Sparkasse KölnBonn, one of Germany’s biggest savings banks with an LBO book in the high double-digit millions of euros. “Where there are no successors, leveraged buyouts are an option.”

Kai Scholze, a board director at Kreissparkasse Esslingen-Nürtingen, agrees with what he said. He said that his bank offers LBO financing in part because it doesn’t want to lose customers to competing banks when a company is bought out. “In this business, the margins are higher than in corporate financing, but there is also a higher risk.”

Kreissparkasse Esslingen-Nürtingen is based in Esslingen, a town from the Middle Ages on the Neckar River in the south of Germany. It has a loan book of about €120 million. It got into the business about ten years ago, and like many of its competitors, it works at the lower end of the buyout market, where banks usually lend about €10 million per deal.

Michael Schuhmacher, a partner at the German law firm Noerr, thinks that the Sparkassen now make up about 20% of the market for LBO financings of up to €20 million. Scholze says that they’ll also work together to do bigger business.

Get More News On FInance:

- Australia Is Going To Raise Its Key Interest Rate, Even Though Economic Growth Is Slowing

- Saudi Arabia Raises Oil Prices For April In Asia And Europe

Scholze said-

“Sometimes seven or eight savings banks work together to get financing volumes of €70 million to €80 million done”

Risky Business

Club deals help spread the risk of being too exposed to times of macroeconomic turmoil, like the 2008 global financial crisis, which hurt Germany’s larger Landesbanks because they had positions in the then-toxic market for mortgage-related securities. Not everyone is sure that moving into riskier assets is a good idea.

Some people say that savings banks, which are regulated by BaFin, were not hurt by the financial crisis of 2008 because they focus on local business. Not so for Landesbanks like WestLB and HSH Nordbank, which had to be saved by the government.

“Even though most savings banks follow the traditional business model of lending to customers, there are a number of institutions whose business policy has nothing to do with fulfilling the public mandate and which also take very high risks on the capital markets,” Ralf Jasny, a professor at Frankfurt University of Applied Sciences, wrote in an analysis of Sparkassen investment policies in 2020.

The banks say they have taken a number of steps to avoid unpleasant surprises. Kreissparkasse Biberach often wants a target’s local lender to be involved, and Kreissparkasse Esslingen-Nürtingen likes LBOs where the buyer writes a bigger equity check.

A deposit protection plan for institutions gives customers of Germany’s roughly 350 savings banks an extra layer of security for their money. Under such a plan, if a lender gets into financial trouble, other lenders in the network can help. People like Jasny still have doubts. In an interview, he said, “Let’s hope it doesn’t end up like Lehman Brothers”

Our motto is “information on time,” and our proud team really takes these words to heart. Journalist PR is a platform that gives you the latest news. We encourage people to check our website often for the latest news.

Leave a Reply