Australia’s central bank is going to raise interest rates for the 10th time in a row at a meeting on Tuesday. Policymakers will have to figure out how to explain a slowing economy and still-high inflation.

Economists all think that the Reserve Bank will raise its cash rate by a quarter-point to 3.6%, which is a level that hasn’t been seen since May 2012. People will be watching to see if Governor Philip Lowe sticks to his prediction that there will be more rate hikes in the future, even though the economy has been getting worse since February.

Australia’s policymakers are meeting at a time when central banks are arguing about when to stop tightening because inflation is staying high. Lowe is having a hard time keeping his message consistent after the RBA thought about taking a break in December, turned hawkish in February after strong data on consumer prices, and now sees slower growth, steady wages, and rising unemployment.

Said Gareth Aird, head of Australia economics at Commonwealth Bank of Australia-

“The RBA may now be tightening policy into an economy that is already showing sufficient signs of softening”

“That said, we wouldn’t be surprised if the RBA simply leaves their forward guidance unchanged for now.”

Lowe will speak at a business conference on Wednesday. He needs to find a way forward at a time when there is a lot of uncertainty. Aird said that “any small changes” in how the governor sees risks are more likely to come out in the speech than in the rate statement on Tuesday.

The RBA is fighting inflation with more force than it has in a long time. Since May, it has raised the cash rate by 3.25 points, which is a 10-year high. The money markets think that the highest rate will be 4.2% this year, which means there will be at least three more quarter-point increases. But there are signs of trouble in the A$2.2 trillion ($1.5 trillion) economy, which grew mostly because of trade in the last three months of last year, when consumption slowed and savings dropped.

But inflation is still high, and the RBA saw signs in the fourth quarter that it was getting worse and getting wider. The central bank did get one sign last month that the CPI may have reached its peak. The latest monthly reading showed that price growth slowed in January, from 8.4% in December to 7.4% in January. There are also problems with the monthly data, and the RBA won’t be sure that the economy has turned the corner until it sees the first-quarter data at the end of April.

Australia’s rapidly improving relations with China and the reopening of the world’s second-largest economy after Beijing gave up on Covid Zero are two things that could change the outlook. Australia’s economy is the one in the developed world that depends on China the most.

As with central bankers all over the world, Lowe’s biggest problem is figuring out how high to raise borrowing costs to get inflation back to the RBA’s 2-3% target without sending the economy into a recession.

South Korea didn’t change its interest rates last month, but it left the door open to more hikes. India is likely to take a break after a weak GDP reading. To deal with persistently high inflation, the Federal Reserve has also slowed the rate of rate hikes and is considering a higher end rate. The Bank of Canada has already said it is moving to the sidelines.

Wanna Read More Latest News:

- Saudi Arabia Raises Oil Prices For April In Asia And Europe

- Abu Dhabi’s G42 Wants To Get $495 Million From The Listing Of Presight Ai

What Bloomberg Economics Says…

“The RBA’s tightening bias is likely to remain in place until its next quarterly forecast review, in May. By then, we expect the data to show enough signs the economy is slowing to persuade the central bank that rates have gone high enough.”

There are reasons why the RBA should do nothing as early as April.

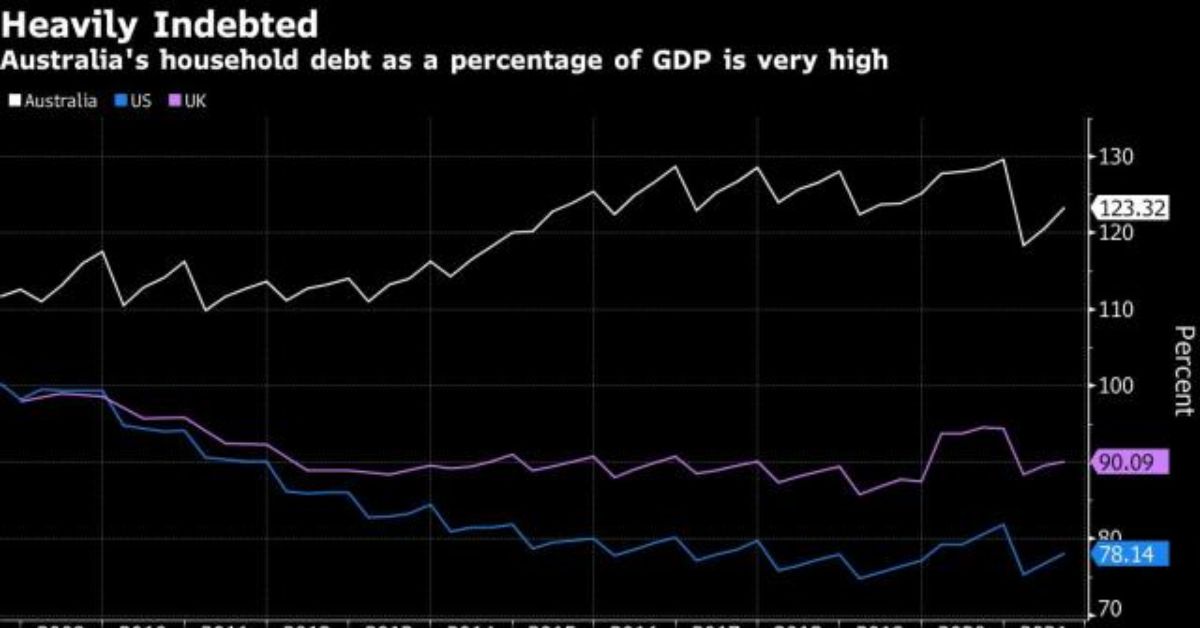

As a result of higher prices and more loan payments, Australia’s households with a lot of debt are using up their savings to pay for daily living costs. There are signs that mortgage stress is getting worse, and even though recent corporate earnings were mixed, they point to more trouble in the future.

Diana Mousina, a senior economist at AMP Capital Markets Ltd., said that the biggest risk to household spending is a big rise in mortgage payments. “We think the RBA and most commentators are underestimating the downside risks to the household sector.”

The average Australian household owes about A$600,000 on its mortgage. Mousina thinks that monthly mortgage payments will go up by about A$13,000 per year as a rule of thumb. “So the question then becomes whether households have enough cash flow to meet these additional repayments.”

If you enjoyed reading this post, please share your feedback with us in the comments box below. In addition, don’t forget to check back on our website Journalist PR for updates on the most recent financial news.

Leave a Reply