The majority of pricing for crude exports to Asia and Europe were increased by Saudi Arabia, which is a signal that the country believes demand for oil will increase in those countries.

Despite the fact that oil futures have experienced a minor decline so far in 2018, many traders and executives in the energy industry anticipate that they will continue to rise, possibly reaching $100 per barrel, as China’s economy improves following the removal of coronavirus lockdowns and inflation slows in other major economies.

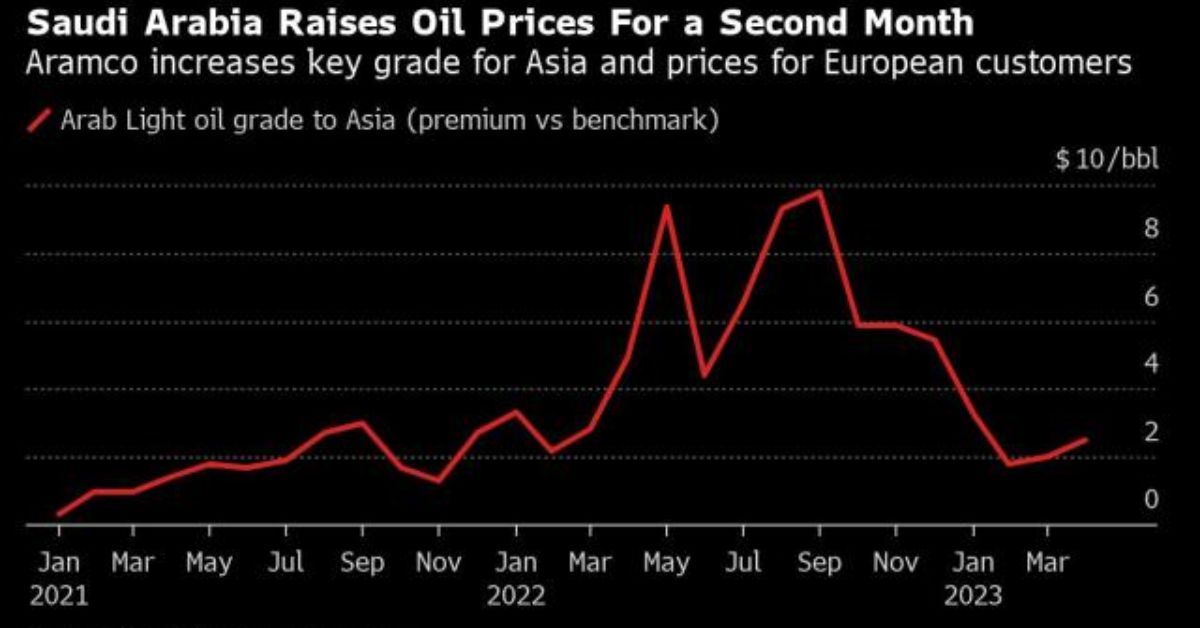

In April, Saudi Aramco, which is controlled by the state, raised the majority of the official selling prices for Asia. The price of the primary Arab Light grade offered by the company was raised to $2.50 a barrel higher than the regional benchmark, which is an increase of 50 cents from the level for March.

This was consistent with the results of a study conducted by Bloomberg among refiners and traders, which predicted a jump of 55 cents. Aramco has now raised prices for Asia, which constitutes the company’s largest market, for two consecutive months in a row. The prices for clients located in the United States have not altered. Prices in North-West Europe and the Mediterranean region increased by as much as $1.30 a barrel.

This year, the price of a barrel of Brent crude has decreased by 1%, falling to just around $85 now. Since the middle of 2022, it has dropped from roughly $115, with a weakening global economy and increasing interest rates counteracting supply disruptions caused by Russia’s invasion of Ukraine. This has caused the price to plummet. The chief executive officer of Aramco said last week that he envisions a turnaround in the company’s fortunes.

Get More Latest News On Finance:

- Abu Dhabi’s G42 Wants To Get $495 Million From The Listing Of Presight Ai

- Stocks Go Up, But China Slows Them Down, And Commodities Go Down

Amin Nasser was quoted as saying to Bloomberg in Riyadh on March 1 that “the demand from China is quite robust.” According to him, it is also “great” in both Europe and the United States.

Along with Russia, Saudi Arabia serves as the head of the OPEC+ group of oil producers and is the world’s largest exporter of oil. The 23-nation coalition has given the impression that it will not increase production before at least the following year.

Aramco exports around sixty percent of its crude oil to Asia; the majority of these sales are made pursuant to long-term contracts, and the pricing for these deals is evaluated on a monthly basis. The largest markets for purchasing are China, Japan, South Korea, and India.

The pricing decisions that the corporation makes are frequently followed by other producers in the Gulf, such as Iraq and Kuwait.

The pricing for Aramco’s barrels in April, in dollars per unit

Asia (against Oman/Dubai)

US (against ASCI) (versus ASCI)

Europe’s North-Western Region (versus ICE Brent)

Mediterranean (vs ICE Brent) (versus ICE Brent)

—Thanks to the help of Anthony Di Paola.

I hope you like our article. If so, please tell us what you think in the comments. You can also add Journalistpr.com. to your bookmarks to get more updates like these.

Leave a Reply