A measure of Asian shares went up in tandem with market futures in the United States and Europe, while Chinese equities went down. Chinese stocks were pulled down by a weak economic growth objective that diminishes the chance of fresh stimulus from Beijing.

Gains in the region were led by Japan and South Korea, where benchmark indexes rose by approximately 1%, following the lead from Wall Street on Friday. Japan’s Nikkei and South Korea’s Kospi both rose by about 1%. The week concluded on a positive note for US markets, fueled by optimism that the Federal Reserve will not hike interest rates beyond the peak levels that have already been priced in.

When investors processed the implications of China’s target of growth of roughly 5%, the stock market in Hong Kong was volatile and the market in Shanghai declined by approximately 0.2%. This set the tone for the decline in the price of commodities ranging from iron ore to copper, which went hand in hand with the decline in the price of oil as investors anticipated that demand may be weaker than some investors had anticipated.

Following changes in US Treasuries on Friday, when the rate on 10-year US notes came back below the carefully watched 4% barrier, government bond yields declined in Australia and New Zealand. Monday saw relatively little movement in Treasury prices across Asia. A measure of the strength of the dollar showed some volatility after a brief increase earlier.

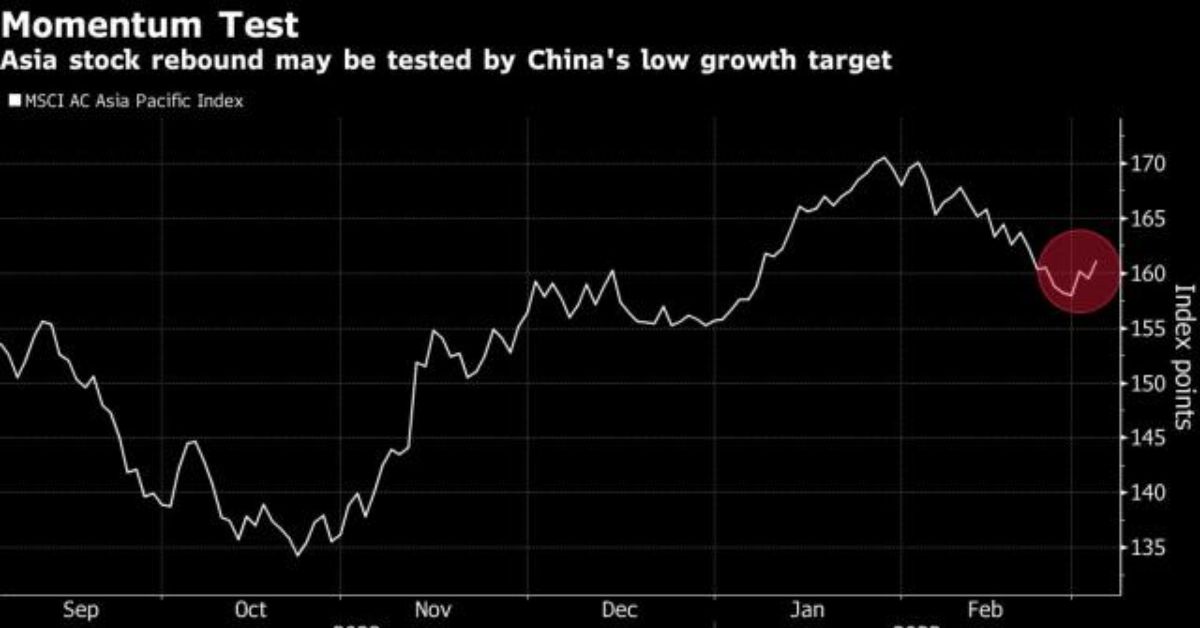

Investors will continue to keep a close eye on the movements of Chinese equity markets in order to gain further insight into the durability of the current upward momentum witnessed in the country as well as more generally across Asia. After falling by about 6% in February, a gauge of Asia’s stock markets saw a 1.5% gain in the previous week.

On Friday, a surge in the S&P 500 helped end a losing skid that had lasted for three weeks, while the Nasdaq 100 had its best day since the beginning of February. In spite of a report that demonstrated resilience in the service sector, optimism remained high since some investors speculated that the impact of the Federal Reserve’s rate hikes on the economy would be postponed.

The rate of cost inflation was measured by looking at the prices paid by service providers, which revealed a reduced growth rate, which traders took as a positive sign. “Rates are going to be higher for longer so we don’t think the strength you’re seeing in the equity market is going to be sustainable in the back half of the year,” Nadia Lovell, UBS Global Wealth Management senior US equity strategist, said in an interview with Bloomberg Television. “We do think you’re going to see a drag on the economy that has implications for corporate earnings.”

More Latest News:

- The Next 13 Trading Sessions Will Decide The Fate Of The Stock Market

- Stable Diffusion, A Competitor To OpenAI, Wants To Raise Money At A $4 Billion Valuation

Investors have a lot of important economic data and events to take into consideration this coming week. In Asia, all eyes continue to be focused on the National People’s Congress in Beijing for any additional policy pronouncements and details that may set the tone for how market-friendly — or punitive — regulation will be through the year 2023.

On Tuesday, attention will be focused on a decision about Australia’s interest rate, and on Friday, the Bank of Japan will make its final policy decision with the current governor, Haruhiko Kuroda, in charge.

The non-farm payrolls report from the United States will be closely monitored by traders across the world in search of hints as to whether or not the economy is able to withstand additional rate hikes. The data from last week indicated sustained strength in the US job market, providing support for the case for the Fed to keep to its tightening policy.

This theme had pushed practically every major asset into the red during the month of February. As Federal Reserve Chair Jerome Powell testifies in front of Senate and House committees this week, investors will also have their eyes fixed to their screens.

Key events this week:

Stocks Go Up, But China Slows Them Down, And Commodities Go Down

- US factory orders, durable goods, Monday

- US wholesale inventories, consumer credit, Tuesday

- Fed Powell’s semiannual Monetary Policy Report to the Senate Banking Committee, Tuesday

- Australia rate decision, Tuesday

- Euro area GDP, Wednesday

- US MBA mortgage applications, ADP employment change, trade balance, JOLTS job openings, Wednesday

- Fed Chair Powell’s semiannual Monetary Policy Report to the House Financial Services Committee, Wednesday

- Canada rate decision, Wednesday

- EIA crude oil inventories, Wednesday

- China CPI, PPI, Thursday

- US Challenger job cuts, initial jobless claims, household change in net worth, Thursday

- Bank of Japan policy rate decision, Friday

- US nonfarm payrolls, unemployment rate, monthly budget statement, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.1% as of 1:43 p.m. Tokyo time. The S&P 500 rose 1.6% on Friday

- Nasdaq 100 futures rose 0.3%. The Nasdaq 100 rose 2% on Friday

- Japan’s Topix index rose 0.8%

- Australia’s S&P/ASX 200 Index rose 0.6%

- Hong Kong’s Hang Seng was little changed

- The Shanghai Composite fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0645

- The Japanese yen rose 0.2% to 135.58 per dollar

- The offshore yuan fell 0.3% to 6.9179 per dollar

- The Australian dollar fell 0.2% to $0.6757

Cryptocurrencies

- Bitcoin fell 0.6% to $22,357.44

- Ether fell 0.7% to $1,561.23

Bonds

- The yield on 10-year Treasuries declined one basis point to 3.94%

- Japan’s 10-year yield was little changed at 0.50%

- Australia’s 10-year yield declined 13 basis points to 3.77%

Commodities

- West Texas Intermediate crude fell 1% to $78.92 a barrel

- Spot gold was little changed

If you enjoyed reading this post, please share your feedback with us in the comments box below. In addition, don’t forget to check back on our website Journalist PR for the most recent information on financial news.

Leave a Reply