According to Michael Wilson, an analyst at Morgan Stanley, the short-term prognosis for US stocks has changed, and he now believes the surge may have more room to run before earnings hurdles increase.

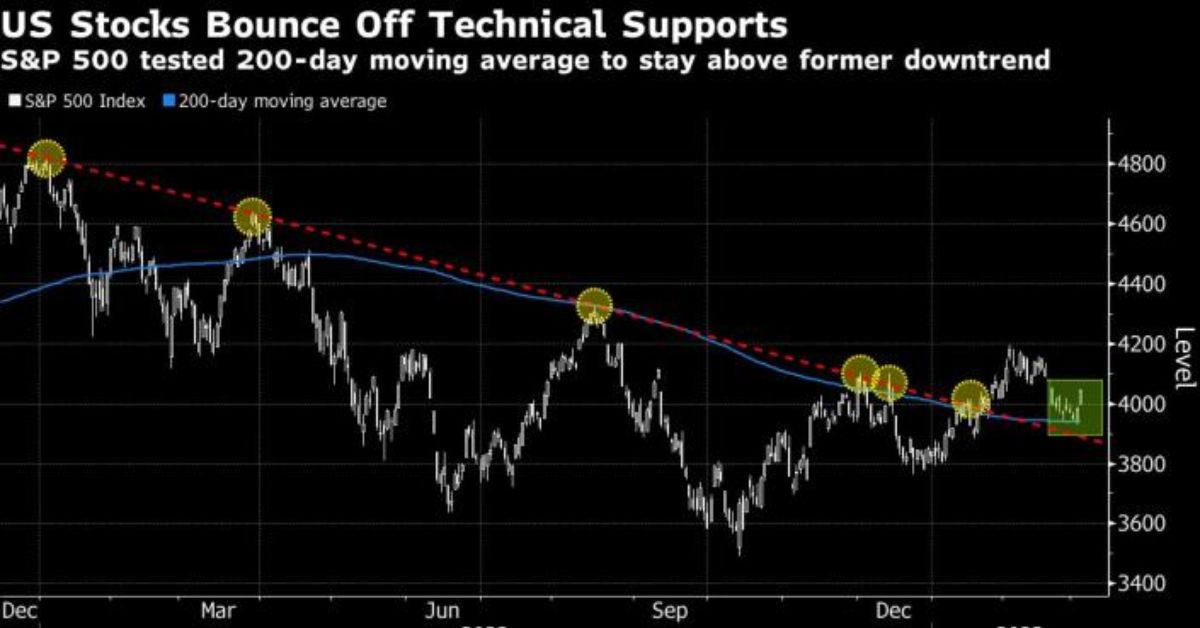

The market expert stated in a letter that was distributed on Monday that “equity markets weathered a vital test of support last week,” which is evidence that “this bear market rebound is not ready to terminate just yet.” Wilson accurately forecast both the decline in stock prices and the subsequent recovery in October.

He made the observation that the S&P 500 maintained its position above its 200-day moving average and that it might experience more gains if the currency and interest rates keep falling in the wake of last Friday’s decline.

Wilson believes that the S&P 500 will encounter its next point of resistance at 4,150, which is approximately 2.5% higher than where it closed on Friday. However, he sees this as a short-term turning point. According to what he stated, the markets have further to fall over the medium term since the fundamentals are continuing to deteriorate, particularly on the earnings front.

Get More Latest headlines:

- Citi Says That The Difference In Value Between UK Stocks And US Stocks Is Driving Listings Abroad

- LBO Bets Give Germany’s Savings Banks A Chance To Play Wall Street

According to Wilson of Morgan Stanley, March Will Bring Bear-Market Hazards.

Despite the rally, “we believe it does not refute the very poor risk reward currently offered by many stocks given valuations and earnings forecasts that remain way too high, in our view,” Wilson said, expecting margins to disappoint the current consensus “by a large amount.”

Wilson stated that the difference between reported earnings and cash flow is the largest it has been in the past 25 years. The gap is being driven by capitalized costs and excess inventory that have not yet been recorded.

Despite hawkish comments from Federal Reserve officials given a robust economy and still hot inflation and jobs data, the S&P 500 has gained 5.4% so far this year, while the technology benchmark Nasdaq 100 has surged over 12%. This is despite the fact that the Nasdaq 100 serves as a benchmark for the industry. The yield on the US 10-year Treasury note reached around 4.2% earlier this week before falling back down on Friday, which helped stocks to rise.

At JPMorgan Chase & Co., strategists led by Mislav Matejka see investors now “more comfortable chasing the market.” They recommend that investors use the current strength to trim exposure because monetary policy tightening will have a lag effect on the impact it has on stocks. Wilson’s caution is echoed at JPMorgan Chase & Co.

According to a note published on Monday, Matejka is also particularly pessimistic about US equities. He argues that relative valuations and earnings are close to reaching historic highs, while at the same time, the market may “keep unwinding some of the strong run that it delivered over the past 10 years.”

Tell us what you think about this article if you liked it. In addition, check back here Journalist PR for updates on the business world as they happen.

Leave a Reply