PancakeSwap is a decentralized exchange based on Binance Smart Chain, with loads of extra features that help you earn and win tokens. It’s quick, inexpensive, and anybody can use it. It also had pancakes and rabbits.

What is PancakeSwap?

Using PancakeSwap, you may swap cryptocurrencies and tokens without the need for a middleman and maintain full control of your tokens at all times. Binance Smart Chain, the blockchain network used by the crypto exchange, provides the foundation for this project’s automated smart contracts.

Despite the fact that Binance runs a controlled exchange, PancakeSwap was created by anonymous developers and is not under the supervision of Binance. Uniswap, a prominent Ethereum DEX, has a striking resemblance to this service.

Binance Smart Chain uses PancakeSwap to run BEP-20 coins, but other platforms’ tokens may be transferred to Binance Bridge and “wrapped” as BEP-20 tokens for usage on the DEX using Binance Bridge.

Read More:

Automated market makers (AMMs) like PancakeSwap rely on user-fueled liquidity pools to facilitate crypto exchanges. Smart contracts allow users to store their tokens in a liquidity pool rather than dealing with an order book and trying to locate another party willing to exchange their tokens for their desired ones. Users that maintain their funds in a pool are rewarded for doing so, and you may make the swaps you choose.

Using PancakeSwap, crypto traders may execute trades with trade tokens without having to pay a middleman a considerable percentage of the monies exchanged. Even though Uniswap has a substantially greater average trading volume on Ethereum than Binance Smart Chain, it is one of the major DEXs on the Binance Smart Chain.

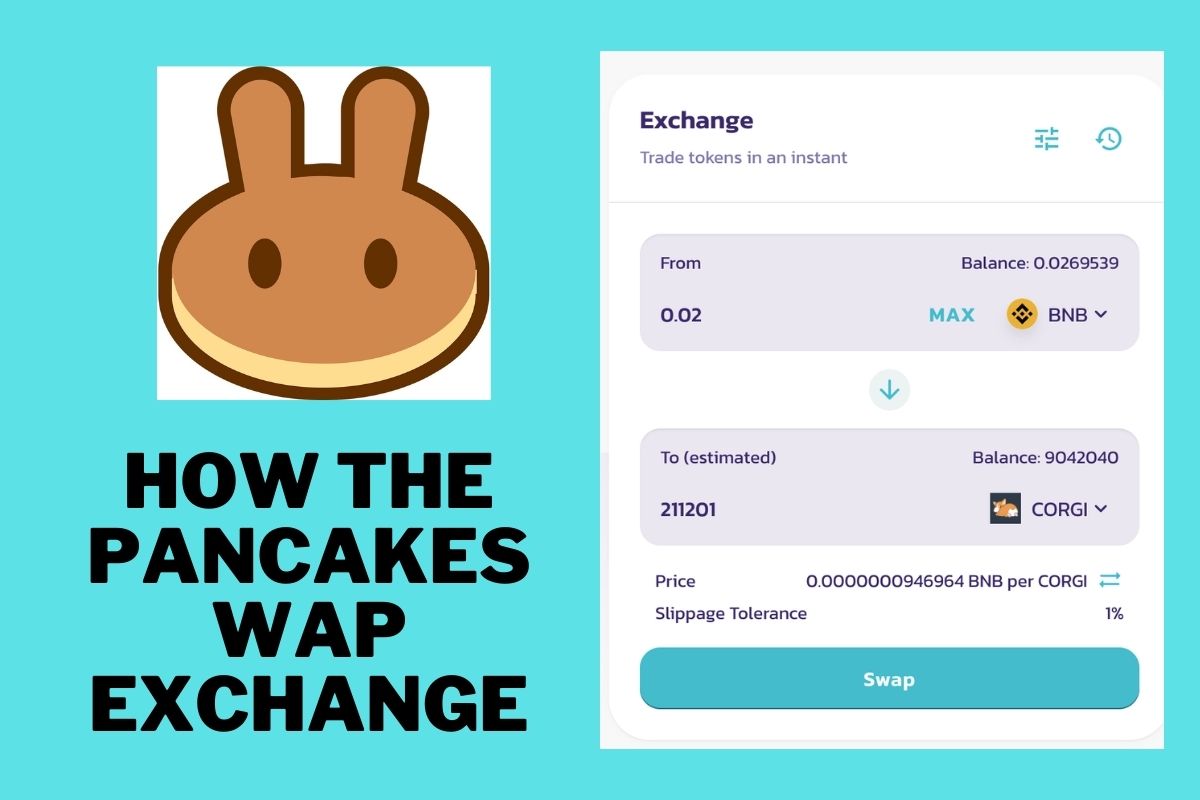

The PancakeSwap Exchange

The PancakeSwap concept is based on an AMM (automated market maker). There isn’t an order book on the site, which implies that you may trade digital assets, but you won’t be matched with anybody else. As a result, you trade against a pool of other traders.

The money in the pools comes from other users. Once they’ve been deposited, they’ll be rewarded with tokens from liquidity providers (also known as LPs). Their part of trading fees and tokens may be reclaimed by using those tokens.

To summarise, you have the option of trading BEP-20 tokens or adding liquidity to the system while earning incentives. Other features will be discussed in the future.

You may get these LP tokens in a variety of flavors, such as BUSD-BNB LP tokens if you contribute BUSD and BNB to the pool. ETH and BETH? ETH and BETH BETH-ETH LP tokens will be awarded to you.

PancakeSwap Farming And Stake

The best is yet to come… PancakeSwap’s governance token, CAKE, may also be formed on the platform.

Yum.

Depositing LP tokens on the farm entitles you to CAKE, a reward for doing so. You may deposit any of the following LP tokens: A sampling of the more popular ones follows, although the full list is available upon request.

- CAKE – BNB LP

- BUSD – BNB LP

- BETH – ETH LP

- USDT – BUSD LP

- USDC – BUSD LP

- DAI – BUSD LP

- LINK – BUSD LP

- TWT – BNB LP

However, the benefits don’t stop there! Staking your CAKE in SYRUP pools might win you even more money.

As a result, you’ve received LP tokens and spent them on CAKE farming. You can then use your CAKE to participate in staking pools and earn more tokens.

In the largest SYRUP pool, you may bet your CAKE to gain even more CAKE! Staking CAKE may get you a lot more tokens, so keep a watch on the SYRUP pool page for updates.

PancakeSwap Is Safe?

CertiK has audited PancakeSwap.

Does that imply that it’s risk-free to use? No. Even if a smart contract is inspected and very respected, there is still a danger of problems while depositing cash. You should never deposit more money than you can afford to lose.

How PancakeSwap Is Work?

Here’s how it all works using PancakeSwap. CAKE, the PancakeSwap token, is used by PancakeSwap to leverage its own utility token.

PancakeSwap’s CAKE token may be used in a number of various ways, including:

- Yield Farming – done through the PancakeSwap farm

- PancakeSwap staking

- The PancakeSwap Lottery

- Voting on Governance Proposals through the Community Governance Portal

PancakeSwap Finance’s CAKE token is clearly useful, but here’s how the rest of the platform works.

Traders use the platform to access one or more of the aforementioned liquidity pools to fund their trades, then rebalance their portfolios after the transaction has closed. PancakeSwap allows users to participate in the process of adding liquidity to pools by holding assets in a compatible wallet, such as the Binance Smart Wallet.

Liquidity is transferred from one side of the pool to the other as a result of these trades, which shifts the pool’s relative value.

These pools of liquidity are bolstered by users who employ smart contracts to secure their tokens. Liquidity pools and traders engage in transactions as a consequence.

For every transaction, the trader is charged a fee, which is split between them and the liquidity providers. CAKE buyback and burn ideas are also included in this chapter.

For More updates and information visit our website Journalistpr.com .

Leave a Reply