HAIFA, Israel, March 22, 2023 — Global container liner shipping firm ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) (“ZIM” or the “Company”) now updates that in connection with the dividend payment anticipated to occur on April 3, 2023 (the “Dividend”),

as previously announced by the Company on March 13, 2023 (“the Dividend”), it had obtained an extension of its prior tax ruling from the Israeli Tax Authority, or ITA, about the tax withholding procedures relating to the payment (the “Ruling”).

The Ruling will also apply if the Company declares any additional dividend payments on or before September 30, 2023.

According to the Decision, some of the Company’s shareholders (referred to as “Shareholders”) may qualify for a lower Israeli withholding tax rate on their portion of this dividend than would otherwise be the case (the “Reduced Withholding Tax Rate”), subject to the criteria and limitations outlined below.

The information provided below only relates to the Israeli withholding tax procedures relating to the Dividend distribution. It is not intended to be a comprehensive analysis of withholding tax rate procedures related to Dividend distribution.

It also does not address the Shareholders’ actual tax liability. There is no assurance the Corporation will declare additional dividends in the future, except for the Dividend it has already announced and will pay on April 3, 2023.

The tax implications of each unique circumstance, as well as any tax implications that may emerge under the rules of any state, local, foreign, or other taxing jurisdiction, are urged to be discussed with one’s personal tax and financial advisors.

To avoid doubt, the Agent (as defined below) has been hired by ZIM to coordinate specific procedures related to the Ruling.

It is NOT intended that the Agent will offer tax advice to any Shareholders; instead, they are urged to speak with their own tax and financial advisors.

Forms that must be submitted to the Agent in connection with the Ruling as outlined below are attached as exhibits 99.2, 99.3, and 99.4 to the Company’s Current Report on Form 6-K,

which was submitted to the Securities and Exchange Commission (SEC) on March 22, 2023 (www.sec.gov) and is available here on the Company’s website.

Background

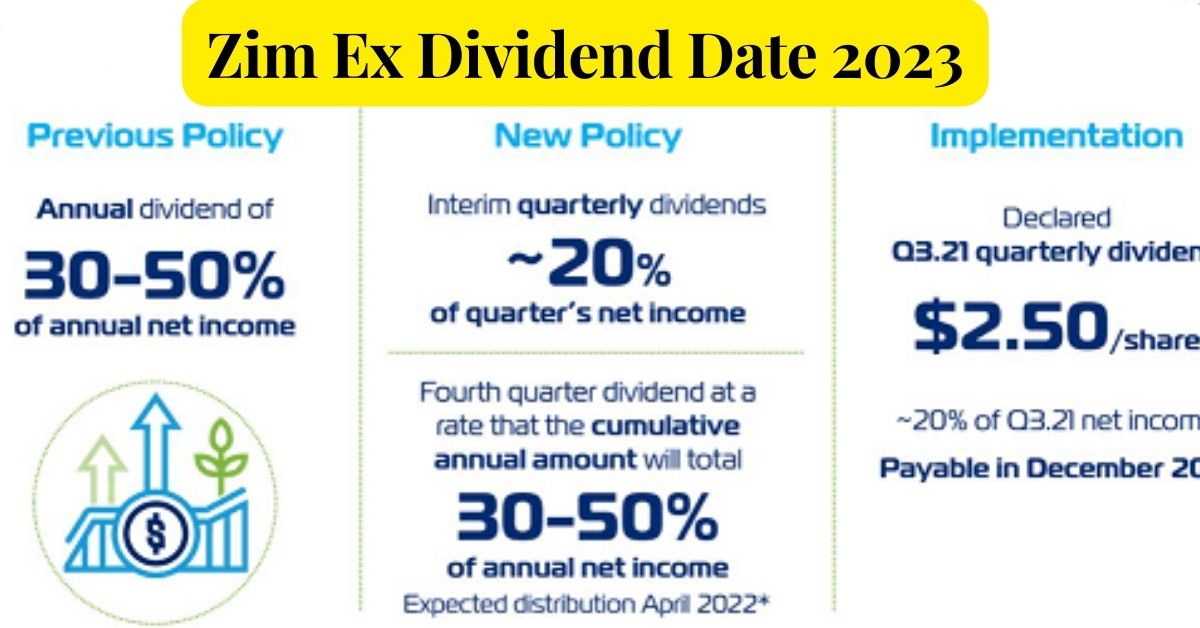

ZIM declared a dividend payment on March 13, 2023, for holders of ordinary shares as on March 24, 2023, of $6.40 per share, or roughly $769 million. The dividend payment is anticipated to occur on April 3, 2023. (the “Payment Date”).

The ex-dividend date for the Dividend distribution was established for April 4, 2023, in accordance with NYSE guidelines, because the Dividend amount per share exceeds 25% of the Company’s ordinary share price as of the declaration date (March 13, 2023).

Hence, until the ex-dividend date, those who want to receive the dividend must hold onto their ZIM shares.

Israeli Law’s General Handling of Withholding Tax

According to the Israeli Tax Ordinance and regulations issued under the Israeli Tax Ordinance (collectively, “ITO”),

the current Israeli rate of withholding tax on dividends paid by an Israeli company is 30% for distributions to “substantial shareholders” (generally, someone who holds, directly or indirectly, by him or her).

This is stated in the Company’s Annual Report on Form 20-F filed with the Commission on March 13, 2023. (“Withholding Tax”).

Despite those above, certain Shareholders, both Israeli and non-Israeli, may be qualified for a lower Israeli withholding tax rate on their portion of this dividend distribution as a result of the Ruling and subject to its terms and conditions (the “Reduced Withholding Tax Rate”),

in comparison to the generally applicable withholding tax rate described above. The terms and conditions are detailed below.

Synopsis of the Decision’s Key Findings

A list of some of the essential terms from the Ruling is provided below. It is important to note that neither the description nor the translation of the Decision down claims to include all its terms and conditions.

Shareholders must abide by all the terms of the Ruling to benefit from the Reduced Withholding Tax Rate. A copy of the Ruling in Hebrew and an unofficial, non-binding translation into English is free by emailing the Agent (as defined below), who can be reached at the numbers listed below:

1. The Company shall deduct 25% of the Dividend amount on the Payment Day and pay the tax amount to the Agent, who will handle it in line with the Ruling’s terms and conditions.

2. The Corporation will pay the remaining 75% of the Dividend amount to its transfer agency, American Stock Transfer & Trust Company, LLC (“AST”), who will then distribute the money to the Shareholders (including through brokers who hold in brokerage accounts ZIM shares on behalf of Shareholders).

3. A Shareholder who resides in a nation with which Israel has a tax treaty (a “Treaty State”) and who is the beneficial owner of the dividend, as well as a Shareholder who resides abroad (i.e., outside of Israel).

Who is the beneficiary of a nation with which Israel DOES NOT have a tax treaty may apply to the Agent for a Reduced Tax Withholding Rate.

The Agent must receive such an application between the Payment Date and May 5, 2023. (“Change of Rate Period”).

4. A Shareholder who declared that they are a resident of a Treaty State and are the beneficial owner of the Dividend may apply to the Agent only during the Change of Rate Period to receive the difference in money between the tax amount remitted to the Agent (at a rate of 25%)

and the amount corresponding to the withholding tax rate specified in the tax treaty between Israel and the United States (at 25%).

5. A Shareholder who did not declare that they are the beneficial owner of the Dividend, a resident of a Treaty State, or both may apply to the Agent only during the Change of Rate Period (subject to meeting all documentation requirements outlined below)

asking to receive the difference in money between the tax amount remitted to the Agent (at a rate of 25%) and the sum represented by the withholding tax rate that applies to the such dividend payment.

6. Any Shareholder who asserts that they are entitled to a Reduced Tax Withholding Rate in accordance with the previous must submit to the Agent no later than May 5, 2023 (the end of the Change of Rate Period),

all pertinent documentation as specified in the Ruling and attached as exhibits 99.2, 99.3, and 99.4 to the Company’s Current Report on Form 6-K filed on March 22, 2023, with the Securities and Exchange Commission (SEC), including but not limited to ban

7. In addition to those mentioned above, the Shareholder shall provide a written declaration in the form attached to this announcement, which shall include the following statements:

The investment in ZIM shares has not been made through a permanent establishment in Israel,

- The Shareholder’s tax residence,

- The Shareholder’s beneficial ownership of the dividend,

- The Shareholder’s holding of ZIM shares is made for the Shareholder’s account and not for the account of others,

- The payment will not be made to a Permanent Establishment of the Shareholder outside of the Shareholder’s Tax Residence.

8. A non-Israeli corporate Shareholder that requests a Reduced Tax Withholding Rate must also give the Agent a copy of its most recent shareholders register as of April 4, 2023,

and documentation demonstrating that more than 75% of its shareholders are, directly or indirectly, citizens of the state where it is headquartered.

9. A publicly traded non-Israeli corporate Shareholder that is a resident of a Treaty State and whose shares are traded on an international stock exchange,

as well as any direct or indirect subsidiaries of such Shareholder shall also provide the Agent with a declaration that it is a resident of such Treaty State or another non-Israeli state, as applicable.

10. An Israeli corporate Shareholder that is eligible for a Reduced Tax Withholding Rate (including an exemption from withholding tax at source) may apply to the Agent no later than May 5, 2023 (the end of the Change of Rate Period),

and must enclose a valid certificate issued by the ITA that specifies the Reduced Tax Withholding Rate or the exemption from withholding tax.

As requested by the Agent, such Shareholder shall also include its certificate of incorporation and any further documents stipulated above.

11. The Agent may, at its discretion, request additional documents from Shareholders applying for a Reduced Tax Withholding Rate insofar as those documents are necessary to determine the Shareholder’s tax residence or whether the Shareholder is eligible for an exemption and/or a Reduced Tax Withholding Rate.

12. Despite what has been said, the Agent may not, unless specifically authorized by the ITA, refund any excess tax withheld from any Shareholder who holds more than 5% of the Company’s issued share capital or who is entitled to more than $500,000 in dividends from the Company under the Dividend.

13. The Agent will transfer the withheld funds, excluding those already returned to the Shareholders.

The Agent shall restore the monies withheld from the Shareholders as described above to the account at which the dividend payment was made within 30 days of the day the sums withheld are paid to the ITA, subject to receipt by the Agent of your requisite paperwork.

14. The Decision does not establish any Shareholder’s actual tax liability about the Dividend or in any other way. It only addresses the question of tax withholding processes.

We hope you like our article. If so, we would appreciate your sharing your insightful ideas in the comments below. You may get even more of these updates by adding Journalistpr.com to your collection of bookmarks.

Leave a Reply