According to a document made by the producer with headquarters in Rio de Janeiro, the company’s board of directors has approved 35.8 billion reais ($6.9 billion) in dividends from the fourth quarter. Additionally, it was suggested that 6.5 billion reais of the dividends be placed aside in a reserve. This proposal would require agreement from the shareholders and would bring the total dividend payout down to 29.3 billion reais.

According to data provided by Bloomberg, Petrobras is the second-biggest payer of dividends in the oil industry, falling just behind Saudi Aramco as the industry leader. Investors have been partially compensated for the underperformance of the shares over the course of the past year by the substantial dividends.

Oil majors all over the world are swimming in cash as a result of the sharp increase in the price of oil that occurred in the previous year. As a result of this, they are under increased scrutiny for making windfall profits at a time when consumers are struggling with inflation. This week, Petrobras was required to pay an oil export tax that will last for four months.

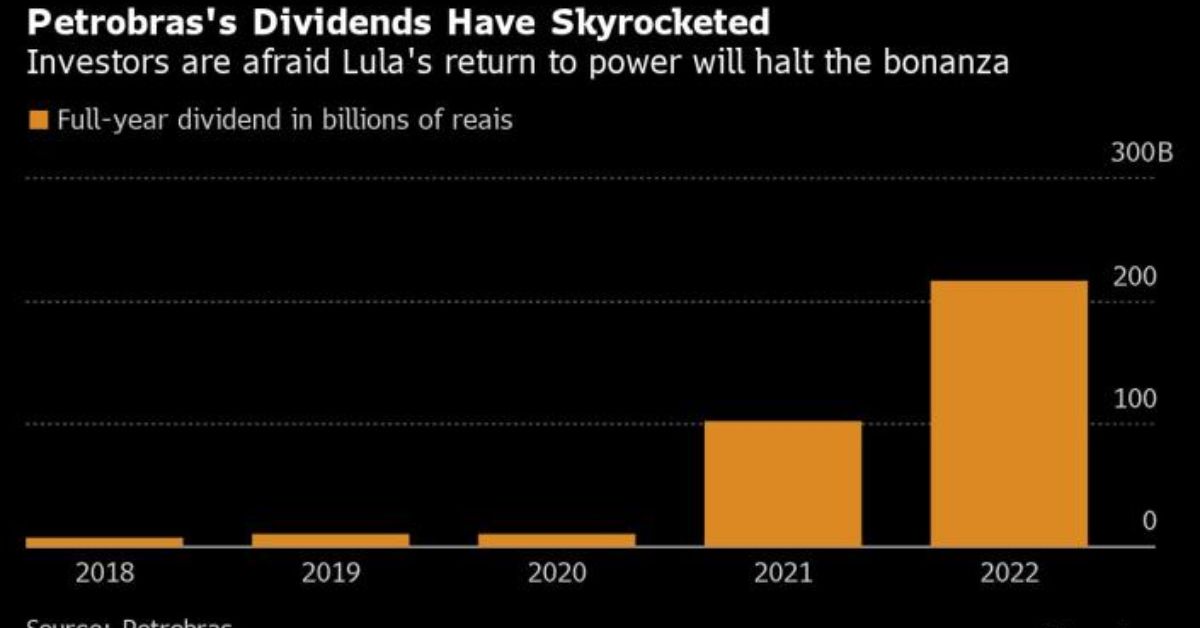

Those shareholders who have maintained their holdings of the company are likely to experience a relief in the form of dividend payments; however, it is anticipated that these payments will decrease in the future. Jean Paul Prates, who was chosen to be the chief executive officer of Petrobras by President Luiz Inacio Lula da Silva, has been critical of the company’s previous management for paying record dividends while ignoring opportunities to invest in renewable energy and refinery expansions.

Petrobras has had a significant recovery over the past six years, which has led to the company being in a position to pay dividends. It has reduced what was previously the largest debt of any oil business, increased production, and cut expenses, which has left Prates with a company that analysts regard to be well-managed and that has a strong balance sheet.

Experts and investors are concerned that, if Prates is elected as president of Petrobras, the company would begin subsidizing fuel in order to assist the government in controlling inflation and will invest in companies that generate lower returns, such as refining. The company is under pressure to keep fuel prices low, and the sale of its assets has been put on hold for the next ninety days.

As a result of falling oil prices, Petrobras’ net income for the fourth quarter was 43.3 billion reais, which was an increase both over the same period last year and the preceding quarter.

Petroleo Brasileiro SA announced a record dividend payment for the whole year in 2022, rewarding investors who remained committed to Brazil’s state-controlled oil producer in spite of fears of political involvement under the administration of President Luiz Inacio Lula da Silva.

Leave a Reply