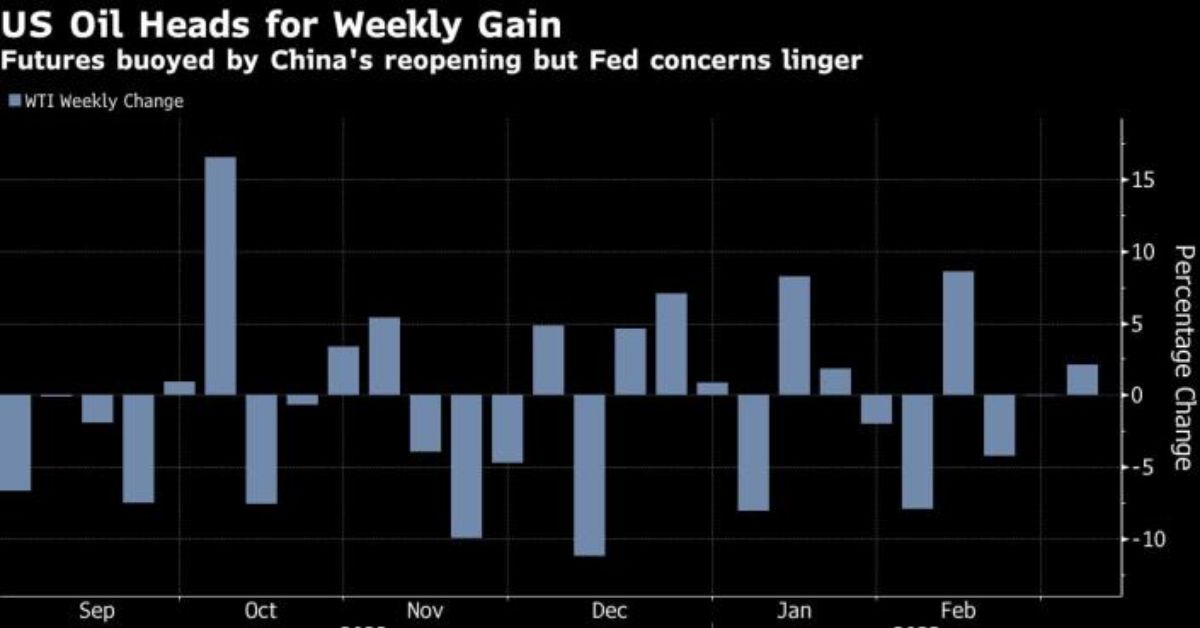

Oil was poised for a weekly rise as optimism on China’s economic revival countered concerns regarding the likelihood of further monetary policy tightening in the United States.

Even though it fell below $78 a barrel, the price of West Texas Intermediate has increased by approximately 2% since last Friday’s finish. Traders set a tone that could be described as cautiously hopeful for the second half of the year during recent days’ gathering in London for International Energy Week, despite the fact that prices continue to be mostly range-bound in the short term.

The price of crude is still stuck in a band of roughly ten dollars, as predictions of increased interest rates from the US Federal Reserve compete with forecasts of more robust consumption from China. While prices continue to struggle to find a direction that is relevant to them, the volatility of the global Brent benchmark has dropped to its lowest level since 2021.

More Latest News:

- Tesla Stock Goes Up After Year-over-year Sales In China Go Up

- Sorry, Fed, But Most US Mortgage Rates Were Locked In When They Were At Their Lowest

Said Keshav Lohiya, founder of consultant Oilytics-

“Volatility continues to be suppressed and it’s not just in oil markets but across most commodities,”

“It’s strange to see volatility so depressed when we have too many geopolitical risks lingering in the background.”

According to a research that Michael Tran and Helima Croft of RBC Capital Markets issued to clients, there are some indications that the rate of mobility in China is picking up speed. Six of the 10 major cities that the bank monitors are seeing daily ridership levels that are higher than they were before COVID was implemented.

There are signs of renewed vigor in the market based on several of its major measures. Since November, the prompt spread for Brent, which is the difference between its two nearest contracts, reached its highest level at the close of trading. This week marked the first time in 2018 that backwardation was seen in the three-month spread for the US benchmark crude oil WTI.

For the sake of our essay, I pray that you enjoy it. If so, we’d love to hear your sage advice in the comments below. Be sure to save Journalistpr.com. in your bookmarks for further information.

Leave a Reply