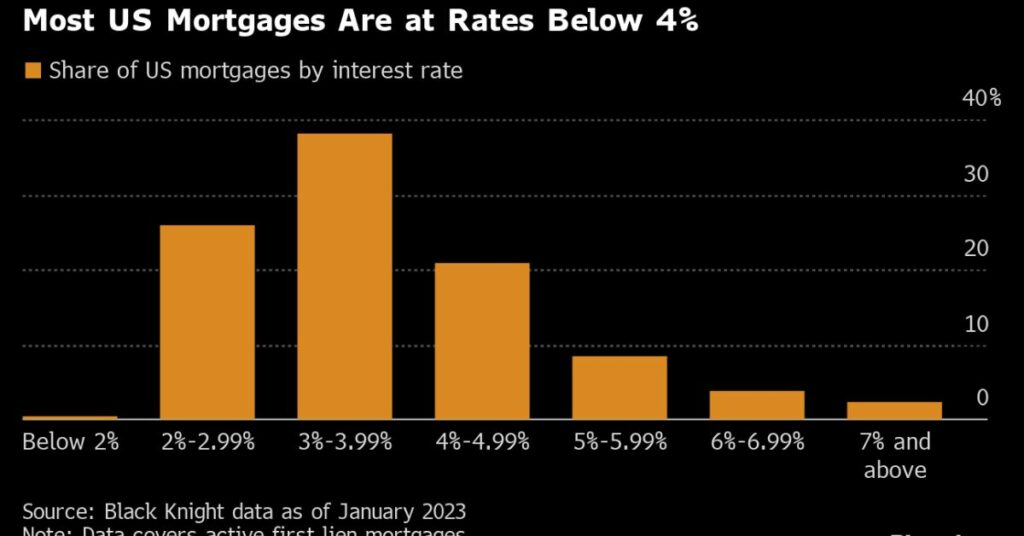

According to data provided by Black Knight, more than forty percent of all mortgages in the United States were initiated in the years 2020 or 2021. This was around the time that the pandemic pushed down the cost of borrowing money to historic lows and sparked a refinancing boom.

According to data provided by Black Knight, more than forty percent of all mortgages in the United States were initiated in the years 2020 or 2021. This was around the time that the pandemic pushed down the cost of borrowing money to historic lows and sparked a refinancing boom.

This is excellent news for all of the homeowners who were able to lock in low-interest loans, but it may not be such great news for the Federal Reserve, which is working to slow down the economy by increasing interest rates.

According to statistics and technology provided by Black Knight, a service for the mortgage industry, about one quarter of all mortgages are from the year 2021. In that year, the cost of a 30-year loan with a fixed rate reached a record low of 2.8% as an average. Another 18% of home loans were originated in the year prior, which was the outbreak year for the pandemic.

The data show one of the challenges faced by the Fed, which is currently raising interest rates at the fastest pace in decades in an effort to bring inflation under control. Because it costs more to get credit, monetary tightening can have the effect of reducing consumer demand. This is one of the ways it works. This is currently having an effect on home markets, since new purchasers are required to pay a down payment of at least 7% of the purchase price.

But the vast majority of homeowners in the United States have fixed-rate mortgages, which are typically much more affordable than the current market rate. Individuals who refinanced their homes during the pandemic have guaranteed themselves additional purchasing power for the years and possibly decades to come.

More Related News:

- Bitcoin Dropped Almost 5% Thursday Night, Which Was Its Biggest Drop In One Hour Since FTX

- After Silvergate Left, A Crypto Hedge Fund Looks To Swiss Banks For Help

Things were somewhat different in the past, back when a greater proportion of Americans held mortgages with variable interest rates. In a report that was released this week, analysts from UBS estimated that the proportion of US mortgage debt that is comprised of floating-rate debt has decreased to approximately 5%, down from a peak of approximately 40% in 2006. According to what they wrote, this is one of the reasons for the “reduced responsiveness of household credit to rising rates.”

In spite of this, there is a clear advantage to switching to fixed-rate mortgages, even if it does make the Federal Reserve’s fight against inflation a little more difficult. When the Federal Reserve raised interest rates by a comparable amount the last time, it was in the middle of the 2000s, when adjustable-rate mortgages were very common. As a direct consequence of this, the housing markets collapsed, and not long after that, so did the global economy.

Share your appreciation of this piece by leaving a comment below. And keep coming back to our site Journalist PR for the most recent updates in the news.