Lazard Asset Management has reportedly begun purchasing shares of Taiwan Semiconductor Manufacturing Co., a chipmaker that was abruptly sold off by Warren Buffett’s Berkshire Hathaway Inc. without any explanation given last month.

The most well-known buy-and-hold investor in the world, Berkshire Hathaway, took an unexpected turn when it reversed its position on TSMC. The multinational corporation with headquarters in Omaha, Nebraska disclosed on February 15 that it had reduced its interest in the company by 86 percent. This news caused investors to dump the company’s shares as they tried to understand the reason for the reduction. According to calculations done by Bloomberg, the value of Berkshire’s share was approximately $5 billion just three months before.

In response to a request for comment on the sale, a Berkshire spokesman did not provide a response. Lazard chose not to comment on whether or not it had increased its holdings in TSMC since the Berkshire filing was made.

According to data compiled by Bloomberg, the portfolio management unit of Lazard, one of the most well-known investment and advisory firms in the world for emerging markets, has TSMC as the second-biggest holding in its emerging-markets equity portfolio by value. TSMC is now the second-biggest holding in its emerging-markets equity portfolio.

‘Mispriced’

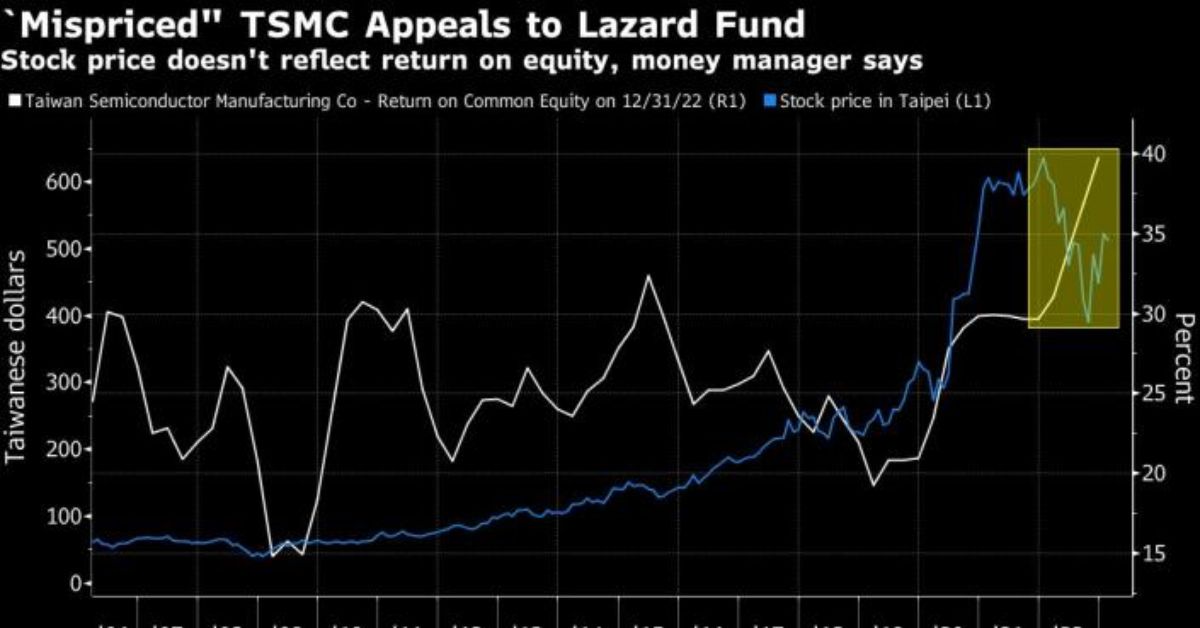

One week after the Berkshire announcement, James Donald, the New York-based head of emerging markets for the $184 billion fund, told Bloomberg that TSMC is one of his favorite stocks and that he has been purchasing more of it lately because it is “far more of a mispriced security today than it was before.”

He highlights the price-to-earnings ratio of the corporation, which has decreased from more than double that to approximately 13, in comparison with a return on equity of more than 30%. Lazard began purchasing the stock in 2006, and Donald stated that he came very close to selling it as well when prices began to appear to be too inflated a couple of years ago.

He said-

“We were very close to selling our entire position, we still had some upside but not a lot, and then the stock derated over the course of the course of last year”

“Since then we have been adding to our positions.”

TSMC, along with other hardware and semiconductor companies, had a 34% decline in value in 2018, as investors considered the impact of supply disruptions caused by Covid 19 as well as a decline in demand for electronics due to rising inflation. During the pandemic, there was a scarcity of chips, which brought to light the fact that the world is dependent on a few number of producers. This issue became a contentious source of rivalry between China and the United States.

TSMC’s US-listed shares have increased by 19% so far this year, and it is the firm that contributes the most weight to the MSCI benchmark for emerging markets. There are no “sell” calls for the stock on Bloomberg, but out of 33 expert recommendations, the stock has received 30 “buy” ratings. Because of this, Berkshire’s decision to withdraw appears to be an even more singular occurrence.

According to data provided by Bloomberg, the performance of the US-listed emerging-markets equities fund managed by Lazard has outperformed more than 90% of its peers and the MSCI index, which has increased by 2.5%. Lazard’s fund has increased by 6.9%.

More Related Latest news:

- Local Officials Say That The Tesla Factory In Mexico Will Be Almost Twice As Big As The One In Texas

- ‘Energy Stocks Look Golden,’ Here Are Three Names That Analysts Like, According To Kevin O’leary

Charlie Munger

Although Berkshire has not commented on the grounds for its turnaround on TSMC, Charles Munger, the 99-year-old vice chairman of the business, spoke about the company during an annual shareholder meeting held by a news publisher called the Daily Journal Corporation one month ago.

According to him, TSMC is “the strongest semiconductor company on earth,” but he also mentioned that the industry is challenging, that there is no surefire winner over the long run, and that competing in the semiconductors industry demands large sums of money.

Munger said-

“The semiconductor industry is a very peculiar industry. In the semiconductor industry, you have to take all the money you’ve made, and with each new generation of chips, you throw in all the money you’ve previously made, so it’s a compulsory investment of everything you want to stay in the game”

“Naturally, I hate a business like that.”

For Lazard’s Donald, though, TSMC’s ability to generate return on lavish capital expenditure is a positive.

He added-

“They have spent substantially on capital expenditure but they have been one of the relatively few companies that have done that and still made very, very good profits”

“It is a rare thing in our opinion to see companies to spend heavily on capex but be able to get a very good return on that.”

I hope you like our article. If this is the case, we would appreciate it if you would share your insightful ideas in the comments below. You may get even more of these updates by adding Journalistpr.com. to your collection of bookmarks.

Leave a Reply