In the next 13 trading sessions, there will be four significant events that will be the key catalysts in determining whether or not the stock market recovery this year gets derailed or starts rolling again following a fall in February.

It kicks off on Tuesday, when Federal Reserve Chair Jerome Powell begins his testimony on Capitol Hill for the two days that make up his semiannual monetary policy hearing. After having the best week it’s had in a month, the S&P 500 Index, investors will be looking for any indication that the central bank may be planning to raise interest rates in the near future.

Emily Hill, founding partner at Bowersock Capital, said-

“The market is clinging to every single positive thing Powell says”

“The minute the word ‘disinflation’ left his lips in a speech earlier this year, the market soared.”

In fact, the rally at the end of last week was caused by Raphael Bostic, the head of the Atlanta Fed, saying that the central bank might take a break this summer.

The February jobs report will be out on March 10 and the consumer-price index will be out on March 14. Any hope that the Fed will start to pull back soon could be dashed by another hot reading on job growth and inflation.

Hill said-

“There are such conflicting signals in the economy,”

“So you’re going to see overreactions from investors to the upcoming data.”

Then, on March 22, the Fed will announce its policy decision and quarterly interest rate projections, and Powell will hold his press conference. After that, investors should have a pretty good idea of when the central bank will stop raising interest rates.

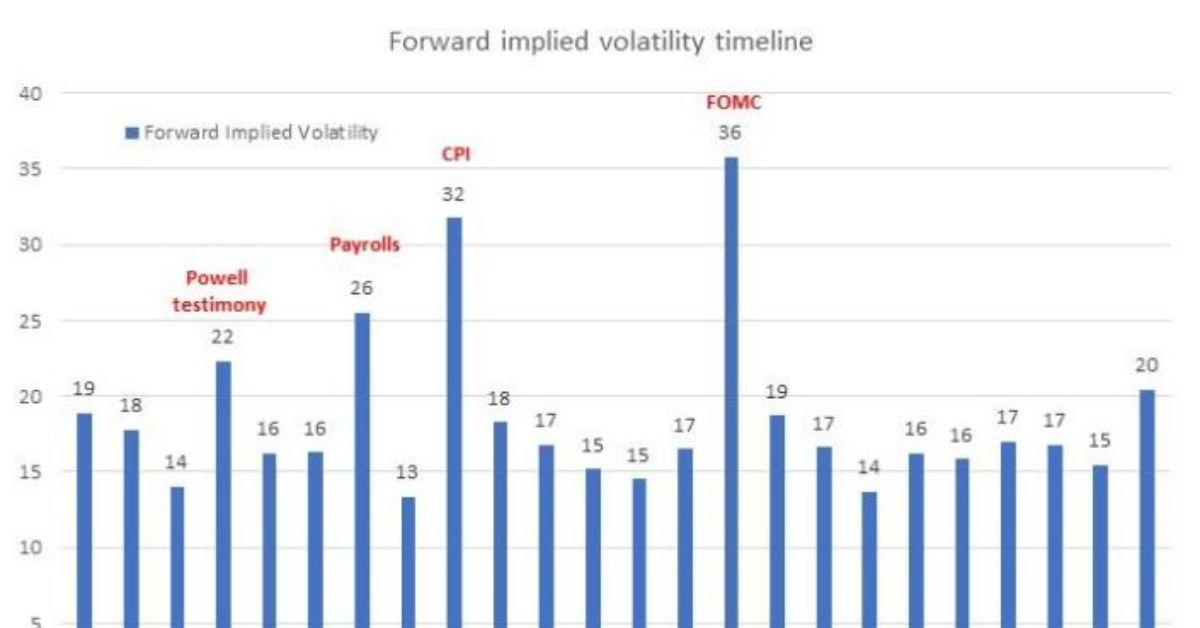

Most of these things make investors worry. Citigroup data show that forward implied volatility is back in the low 30s for the day of the consumer price index and is close to 40 for the day after that when the Fed decides on interest rates. This means that traders are betting on big swings. Stuart Kaiser, head of US equity trading strategy at Citigroup, says that a forward implied volatility reading of 26 on the day of the jobs report shows that the market is underpricing this risk.

As for the stock market itself, most people have felt calm about it. For the three trading days that ended on March 1, the S&P 500 moved less than 0.5% in either direction each day. The last time this happened was in January, when investors bet more that the US economy might avoid a recession because inflation is going down.

More News:

- Stable Diffusion, A Competitor To OpenAI, Wants To Raise Money At A $4 Billion Valuation

- Coinbase, Paxos, And Galaxy Will No Longer Accept Transfers Through The Silvergate Network

Here are the things that traders will be watching.

Testimony of Powell

The Fed chair’s biannual monetary policy report to the US Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday is likely to give hints about the future of the US economy, especially inflation, wage pressures, and employment. Traders will also look for hints about what else the Fed will do to keep prices down.

Jobs Report

In January, the job market was strong. This is a major cause of inflation, since rising wages can keep prices high. And it could hurt stock prices because the Fed wouldn’t be able to stop raising interest rates. Economists think that the unemployment rate in February will be 3.4%, the same as in January. After a sudden jump of 517,000 jobs a month ago, growth in nonfarm payrolls is expected to slow down to 215,000. But in the end, it all comes down to wages and whether or not the Fed thinks they are slowing fast enough to bring down inflation.

Data on Inflation

After a big jump at the beginning of the year, the consumer price index reading for February is very important. Any sign that inflation isn’t going away could make the Fed raise rates even more than was already expected. The expected CPI for February is 6%, which is better than January’s 6.4%. Core CPI, which takes out the volatile food and energy parts and is seen as a better indicator of underlying trends than the headline measure, is expected to rise 5.4% from February 2022 to February 2022 and 0.4% from February 2022 to February 2022. The Fed’s goal for inflation, which is not just based on the CPI, is 2%.

Fed’s Choice

The market thinks that interest rates will peak in September at 5.4%, which is almost 1% more than the current effective federal funds rate. Traders are getting ready for the possibility that the Fed will start raising rates by a lot again. Overnight index swaps are pricing in a tightening of about 31 basis points later this month.

Obviously, what the Fed thinks will happen in the future and what Powell says after the decision will affect how the market feels. But Michael Antonelli, a market strategist at Baird, says that big misses, like inflation readings that are much higher than expected, would stop the stock market from trying to recover.

Antonelli said in a phone interview, “If the terminal rate goes from 5% to 5.5%, that will be a headwind, but it won’t crash the stock market like it did last year.” “Last year, we didn’t know what the worst-case scenarios would look like, but this year, there are fewer possible outcomes. And that’s what investors like.”

I hope you like our article. If this is the case, we would appreciate it if you would share your insightful ideas in the comments below. You may get even more of these updates by adding Journalistpr.com. to your collection of bookmarks.

Leave a Reply