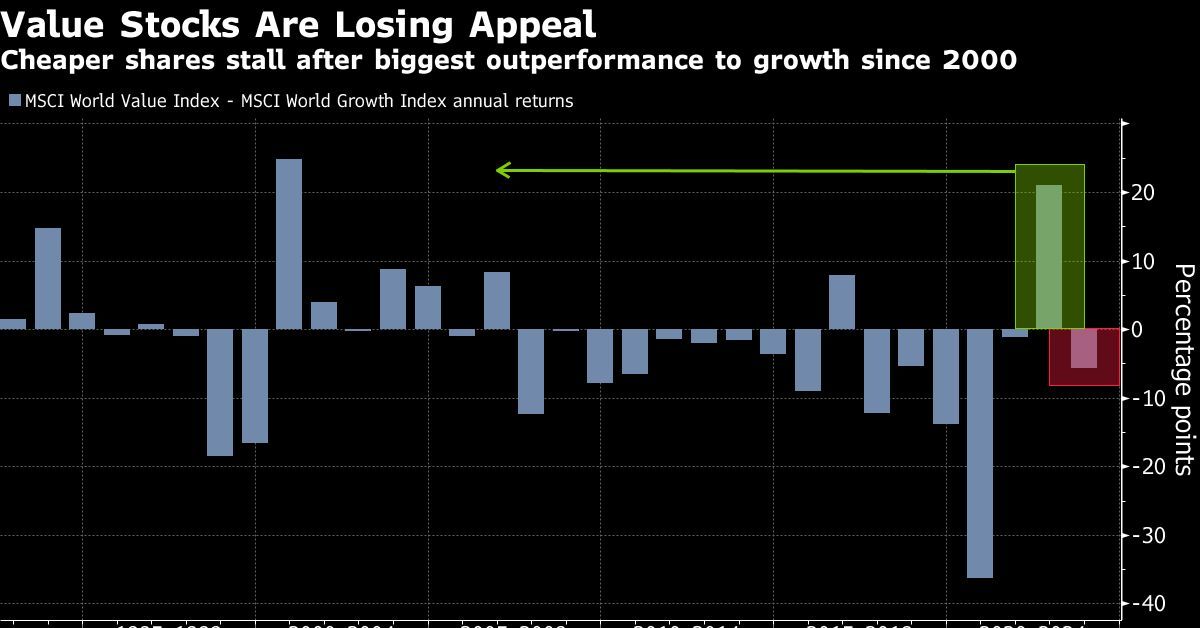

According to the strategists at JPMorgan Chase & Co., the remarkable outperformance seen in cheaper, so-called value stocks over growth rivals during the previous year is likely to reverse soon as the economic recovery slows.

In 2022, the value trade was a popular choice in the market; however, it is beginning to lose its luster. The group that is being managed by Mislav Matejka has written in a note that the following step for investors in the following month or two might be to go “outright underweight value against growth.”

He wrote on Monday-

“Our core view is that in the second half, market will be moving back to the recession trade, but even if the opposite scenario gains traction, value might not be the best place to be”

After outperforming their growth counterparts for the past year by the most since the dot-com boom of 2000, value equities have recently started to stagnate in comparison to growth rivals. Even while the cheaper shares have received a boost from rising bond rates and inflation, investors are beginning to price in more hawkish policy, which may diminish support for the trade as yields reach their peak.

Since the market bottom in September, value stocks like those belonging to banking and commodity firms have seen significant gains. On the other hand, growth stocks have seen losses due to rising interest rates, while highly valued industries like technology have experienced a squeeze on profits. At the beginning, the trade was also supported by macro data that was superior to what was anticipated.

But now, according to Matejka, the velocity of economic activity is likely peaking and could start rolling over shortly, while slowing inflation expectations signal that the value factor shouldn’t fair so well relative to growth from here on out.

The strategists do not currently have a preference towards value or growth at this time. On a time horizon of two to three years, they believe that cheaper equities will be more intriguing to invest in than growth rivals; nonetheless, they anticipate that the group will suffer losses this year.

Matejka wrote-

“Better relative tech performance than what transpired last year would ensure value factor is not a winner this year”

More Finance News:

- JP Morgan Says That If The Chart Test Fails, Quants Should Sell $50 Billion Worth Of Stocks

- Stocks Moving After The Market Closes: Zoom, Occidental Petroleum, Workday

But, according to BlackRock Investment Institute, value stocks have the potential to continue their ascent after growth stocks led the US advance up to this point in the year. This is because major central banks are expected to hold interest rates higher for a longer period of time. The argument that increased borrowing costs diminish the value of future cash flows and put a greater burden on growth equities is put up by strategists led by Wei Li.

According to Li, persistently high inflation “is likely to lead investors to demand more compensation for holding long-term government bonds, driving higher yields,” she wrote in a note to clients on Monday. “This is likely to lead investors to demand more compensation for holding long-term government bonds.” When the yield curve becomes more steep, value investments typically do better than other types.

Our motto is “information on time,” and our proud staff places a high weight on the meaning of these words. The Journalist PR platform offers the most up-to-date information available. We strongly encourage visitors to our website to check back frequently for the most recent updates.

Leave a Reply