The emerging-market bulls on Wall Street are becoming increasingly hesitant to declare that a new dawn has arrived for riskier assets. Instead, they are choosing for a more cautious approach to the currencies of developing nations.

While the bulk of the Federal Reserve’s aggressive rate rises have already been completed, some of the most successful investors in the world anticipate that the dollar will soon begin to slip into a trend of weakness that will last for several years. A change of this nature is likely to benefit emerging markets, and it was one of the driving forces behind gains of roughly 9 percentage points in developing currencies from the end of October to the beginning of February.

Yet the market upheaval this month, which occurred in conjunction with a strengthening of the dollar, has caused some prospective purchasers to hold off.

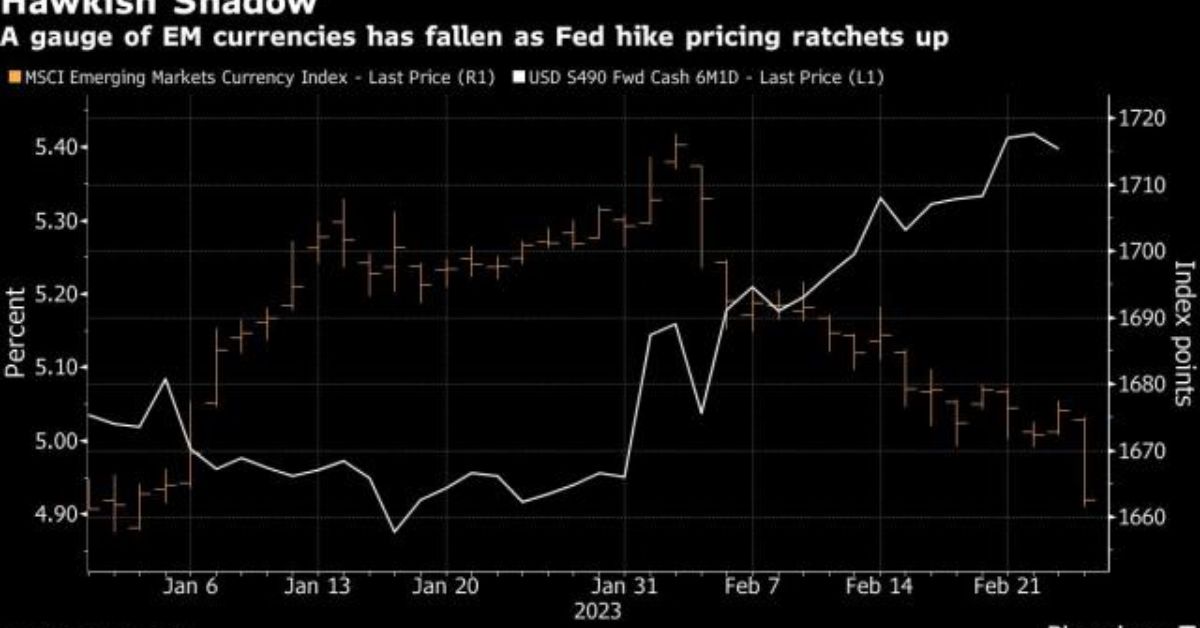

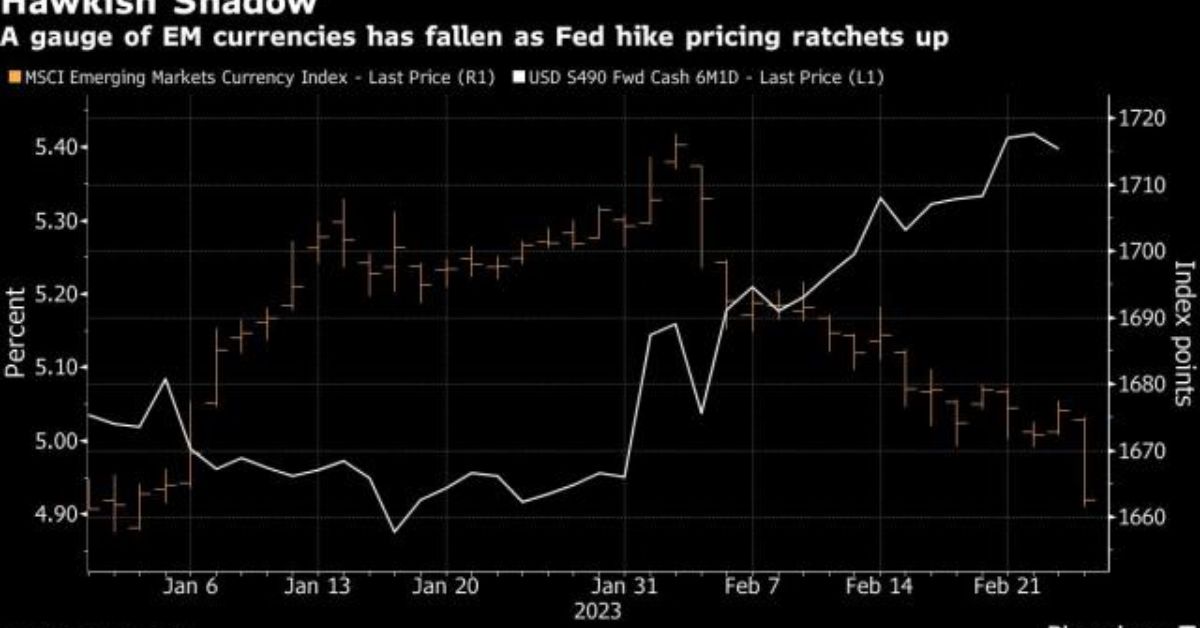

Money managers from abrdn Plc to Fidelity Investment are leery of getting caught on the wrong side of the recent dollar rise. This is especially true in light of the fact that the MSCI Inc. index of developing currencies has erased almost all of its gains for the year to date.

Said James Athey, investment director of rates management at abrdn in London-

“We are concerned on a more tactical basis that EMFX has moved too far too fast”

“The Federal Reserve is not yet done hiking, there remains much uncertainty around the inflation outlook, and we fully expect a US/global recession in the next six to 12 months”

This concern was brought to the forefront on Friday as an unexpected acceleration in the Fed’s preferred price gauge boosted the probability of higher US rates remaining in place for a longer period of time and pushed the dollar higher.

The benchmark currency for currencies used by developing nations saw its losses accelerate on Monday, erasing the gains it had made over the course of the year. The index is currently on track to have its lowest monthly performance since September. A indicator of appetite for emerging-market currency risk that was developed by JPMorgan Chase & Co. has also decreased this month, hitting negative for the first time this year in the middle of the month of February.

The Thai baht has already given up all of the gains it made at the beginning of 2023, which had occurred in response to optimism regarding the return of Chinese tourists. And the South African rand, which is frequently used as a stand-in for investors’ willingness to take risks, has returned to levels that were last seen in late 2022.

Even before Friday’s increase in the value of the dollar, abrdn had taken a neutral posture on the asset class. They were waiting for values to fall and for them to reflect a recession. Investors with Fidelity International are currently purchasing the dollar in order to gain value versus the Polish zloty and the Philippine peso. In the meantime, Goldman Sachs Group Inc. is sounding the alarm about a possible difficult future for the US rate-sensitive South African rand.

More News:

- China’s Investigation Of Lithium Shuts Down 10% Of The World’s Supply

- China’s Hotpot Chain Grows By 20% As Cost Cuts By COVID Pay Off

Many areas of relative stability

But, there is still a rationale for being selective because the currencies of some developing economies have been able to resist the recent surge of the dollar.

The Mexican peso and the Peruvian sol have so far bucked the trend and strengthened against the United States dollar in February. This has been made possible by local inflation cycles and commodities.

“The LatAm block appears to be much further ahead on the inflation and policy tightening cycle compared to other emerging markets,” said Paul Greer, a London-based money manager at Fidelity. “This has resulted in the region offering very high ex-ante real yields, which is supportive of foreign portfolio inflows entering local bond and FX markets.”

Certain Asian currencies are also better positioned to withstand a period of dollar strength, according to Alvin Tan, the head of Asia FX strategy at RBC Capital Markets in Singapore. This is especially true in the event that excessively tight monetary policy causes economic recession in major economies.

He said-

“The Korean won and Thai baht still look relatively cheap to me”

“If indeed Asia can avoid a recession this year, then I expect further upside to regional assets and FX.”

Where to Look

- After Nigeria’s election on Saturday, investors will pay close attention to the results and effects of the vote. Both gasoline and naira notes have been in short supply all over the country, which has caused chaos at gas stations and banks.

- In February, China’s PMI surveys will show how the recovery is going. Bloomberg Economics expects good news.

- India and Turkey will report their GDP, which will give us an idea of how growth in emerging markets went in the last part of 2022.

- Bloomberg Economics says that Brazil’s GDP numbers and employment data for December will show that the economy slowed down in the fourth quarter.

- The central bank of Mexico is going to put out a quarterly inflation report. This report will include the latest economic predictions and hints about how monetary policy will change in the future.

Our motto is “information on time,” and our proud staff places a high weight on the meaning of these words. The Journalist PR platform offers the most up-to-date information available. We strongly encourage visitors to our website to check back frequently for the most recent updates.

Leave a Reply