In Sri Lanka, hospitals are putting off surgery. Nigeria has stopped all international flights. Pakistan shut down its car factories.

Things are bad on the ground in some of the most vulnerable developing countries in the world. Lack of dollars makes it harder to get things like raw materials and medicine. While governments try to get help from the International Monetary Fund, they are struggling with their debts.

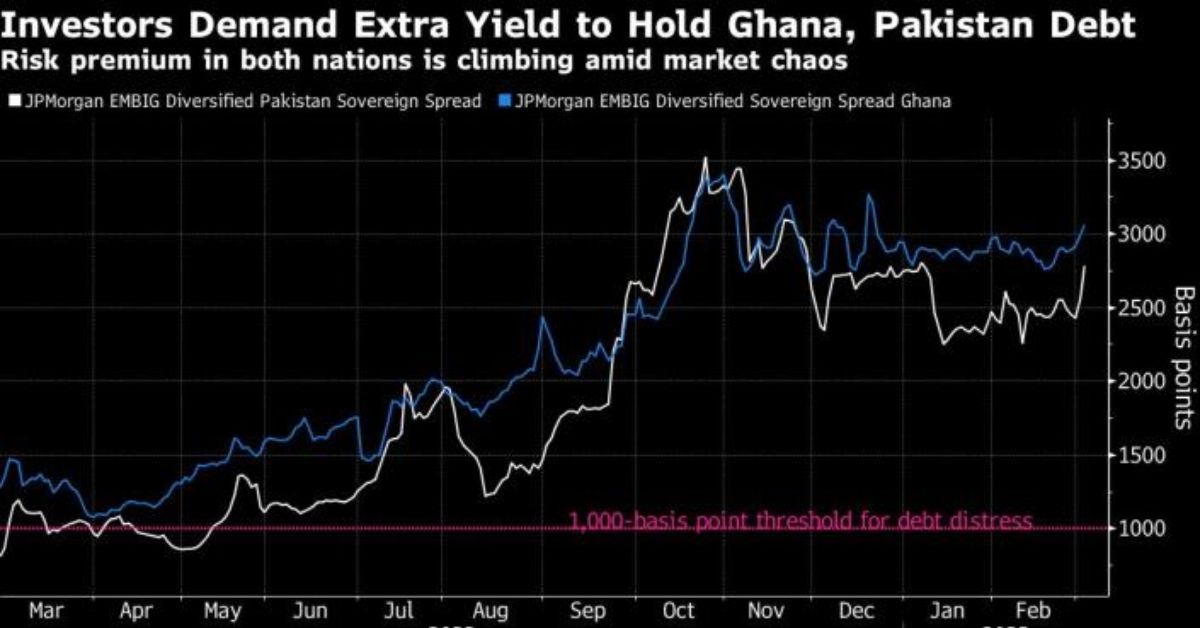

It’s making Wall Street rethink its optimistic view of emerging markets, which was popular just a few months ago. Even though few people thought that the problems in some frontier economies would be solved this year, the pain has gotten worse as the dollar has risen.

Trouble on the edges of the developing world probably won’t bring down the asset class as a whole, but some say it will force money managers to be more strategic about how they invest in the coming months.

Hasnain Malik, an emerging and frontier-market strategist at Tellimer in Dubai, said, “There’s a real crisis brewing in these troubled countries, and for some, things could still get even worse.” “Investors will have to be even more careful about looking for signs of weakness and differentiating between different types of country risk if they don’t want to be caught off guard by the next Ghana or Sri Lanka.”

In Pakistan, factories haven’t been running for months because they don’t have enough hard currency to buy raw materials. In Sri Lanka, the government has set a limit of 20 liters of fuel per person per week. Also, because of a lack of drugs and other medical supplies, government hospitals are putting off surgeries that are not urgent.

Not to mention the international airlines that stopped flying to Nigeria because it was hard to get dollars out of the country. Bangladesh’s power producers want the central bank to give them $1 billion in foreign currency so they can buy fuel and avoid an energy crisis. Malawi is also running out of medicines, fertilizer, and diesel because imports are going down because of the dollar crunch.

The Next Generation Markets Index from JPMorgan Chase & Co., which tracks the dollar debt of what it calls “pre-emerging countries,” fell 0.4% last month, the most since September. And even though the dollar has been strong lately, the currencies of Ghana, Egypt, Pakistan, and Zambia have dropped much more than their global peers this year.

Because of this, some money managers are taking a more careful approach. This is a change from the general optimism about emerging markets at the start of the year.

Said John Marrett, senior analyst at the Economist Intelligence Unit in Hong Kong-

“These countries are mired in economic collapse, and some like Pakistan are teetering on the edge of another default” “Major parts of their economies are struggling. The currencies are worth far less too”

More Latest News Headlines:

- Morgan Stanley Strategist Wilson Thinks The US Stock Market Will Go Up In The Near Future

- Citi Says That The Difference In Value Between UK Stocks And US Stocks Is Driving Listings Abroad

Fitch Ratings said in a report on Monday that frontier markets may still face problems from the outside this year, such as a still-strong US dollar, high yields, and trouble getting into the bond market. It also said that a drop in reserves could lead to more downgrades in credit ratings.

More risk-averse money managers, on the other hand, are looking for good yields in government debt from countries that have kept their budget deficits in check and their currencies stable. Barclays Plc has said that Mexico and Colombia are heading toward more consolidation of their finances.

Cycle of Danger

For countries like Sri Lanka, the problems started years ago when officials spent valuable hard currency reserves to keep local exchange rates artificially high.

But it was Russia’s war in Ukraine and the Federal Reserve’s aggressive tightening of policy that pushed the dollar to levels not seen in a generation. As energy and food prices went up, they took money out of the pockets of many economies on the edge.

“It’s tempting to say there’s an EM crisis because of the Fed tightening, but that takes the human agency away from policymakers in select countries that were enacting unsustainable fiscal policies,” said Samy Muaddi, head of emerging-markets fixed income at T. Rowe Price in Baltimore. “That said, tighter financial conditions are now exposing policies in some of these countries that are proving unsustainable.”

About a dozen countries are waiting in line to get help from the International Monetary Fund. However, progress has been slow for countries that are still trying to work out their debts. Several countries with a lot of debt, like Egypt, Pakistan, and Lebanon, have already lowered their exchange rates this year to get access to rescue funds. Currency traders are getting ready for a possible wave of devaluations.

Brendan McKenna, an economist and strategist for emerging markets at Wells Fargo Securities LLC in New York, says that people who are willing to take risks can find opportunities in countries that have a clear plan for reform and a way to get help from official lenders like the IMF.

He said-

“Pakistan, Sri Lanka and Ghana — maybe now is not the time to deploy capital there”

“But Egypt could be an opportunity if the IMF program is successful at supporting the economy while tough reforms are implemented.”

Where to Look

- China will be in focus as the National People’s Congress, which opened on March 5, will set the economic and social agenda for the coming year. In the coming week, the country will also report on exports, consumer price inflation, and factory-gate prices.

- Traders will keep an eye on inflation numbers from the Philippines, Thailand, Russia, Mexico, and Chile.

- Poland’s central bank is likely to keep the key interest rate at 6.75% as the nation’s tightening cycle ends. Bloomberg Economics thinks that the next step will be a cut in interest rates, which could happen in the second half of 2023.

- The benchmark rate from Bank Negara Malaysia is likely to stay the same.

- Peruvian policymakers will meet Thursday to decide their key rate.

- Bloomberg Economics says that the IPCA data for February in Brazil will likely shed light on the rate of deflation.

Our motto is “information on time,” and our proud team really takes these words to heart. Journalist PR platform provides the most recent latest News. we appeal to readers to frequently check our website for the latest updates.

Leave a Reply