CRH Plc has announced that it intends to relocate its major listing from London to New York, which will deliver an additional blow to the status of London as a global financial center.

“A US primary listing would bring increased commercial, operational and acquisition opportunities for CRH,” the £32 billion ($38 billion) maker of building materials said in a statement on Thursday.

Due to its larger pool of cash and more extensive investor base, the United States market is attracting an increasing number of businesses from throughout the world, including the Dublin-based enterprise. As a blow to UK lawmakers who were lobbying the home-grown technological powerhouse in advance of its initial public offering, Arm Ltd. has opted not to sell shares on the London Stock Exchange for the time being.

Said Russ Mould, a director at retail investment platform AJ Bell-

“It should be a badge of honor to list in the UK, but that reputation is dwindling fast” “Overseas investors lost interest in the trading venue as soon as the UK voted in favor of Brexit.”

According to the statement, CRH will continue to keep its corporate headquarters, as well as its incorporation and tax residency, in Ireland. At the moment, the company is listed on the stock exchange in two locations: the principal one is in London, and the secondary one is in Dublin.

Flutter, Ascential

As early as this year, the $28 billion gambling giant Flutter Entertainment Plc announced that it was preparing for a secondary US listing. At the same time, Ascential Plc, a data-and-analytics company that is listed on the London Stock Exchange, announced in January that it was planning a separation and listing of its digital commerce assets in the United States as part of a strategic review.

The primary listing for Abcam Plc, a biotechnology business with headquarters in Cambridge and a market value of approximately $3.3 billion, was transferred from London to the Nasdaq last year. Yet, since then, its shares have dropped by over 7% as a whole.

The level of liquidity in London has decreased. When compared to almost £14 billion during the same time period in 2007, the average daily traded volume on the FTSE All-Shares Index was about equivalent to approximately £4 billion during the month of February this year.

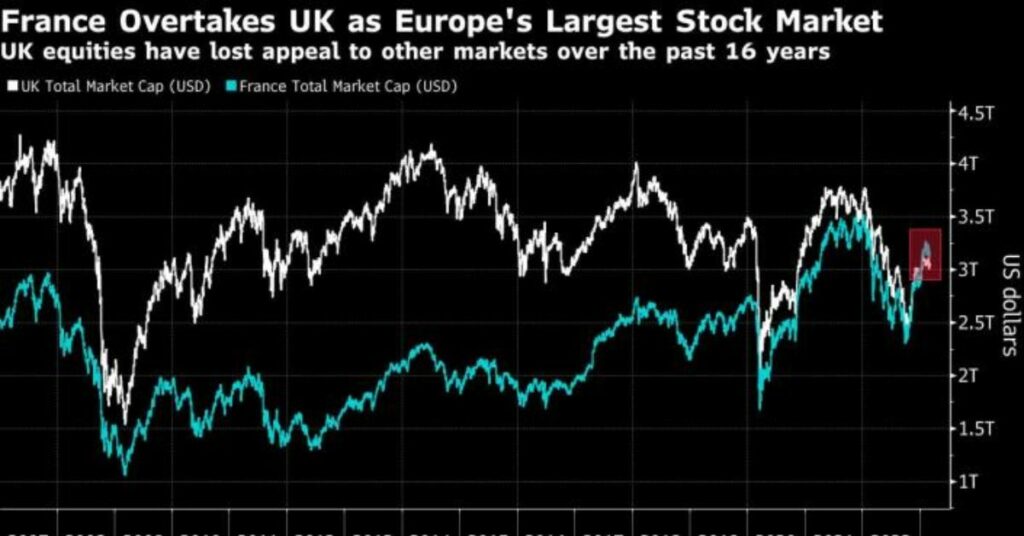

Also, during the past 16 years, there has been a gradual reduction in the size of the stock market in the United Kingdom. After reaching its highest point of $4.3 trillion in 2007, the overall market capitalization of London-listed shares has fallen to approximately $3 trillion this year.

Another blow to the supremacy of British finance was dealt last year when France overtook the United Kingdom as the country with Europe’s largest stock market. According to data published by Bloomberg, the total market capitalization of the United States stock market increased from $19 trillion to $43 trillion during the same time period. This is a comparison to the growth of the US stock market, which more than doubled in size during the same time period.

After several years of participation in the FTSE 100 index, the plumbing and heating supplies group Ferguson Plc made the decision in 2021 to shift its primary listing to the United States. According to a report published by the Financial Times this week, executives at Shell Plc considered relocating the company’s stock market listing and headquarters from the United Kingdom to the United States in the same year. Such a move would have caused shockwaves to travel throughout the business community in Britain.

The British pharmaceutical company GW Pharmaceuticals Plc, which specializes in cannabis medication, relocated its major listing to the United States in 2021, the same year that it was acquired by Jazz Pharmaceuticals Plc for a total of $7.2 billion in cash and stock.

Analyst Ross Harvey from Davy Research stated on Thursday that he sees “merit and strategic rationale” for CRH’s decision, and analyst Lars Kjellberg from Credit Suisse Group AG added that the shift might enhance the valuation of the company’s shares.

Leave your comments if you enjoyed reading this post. Remember to check back here Journalist PR for the latest business updates.