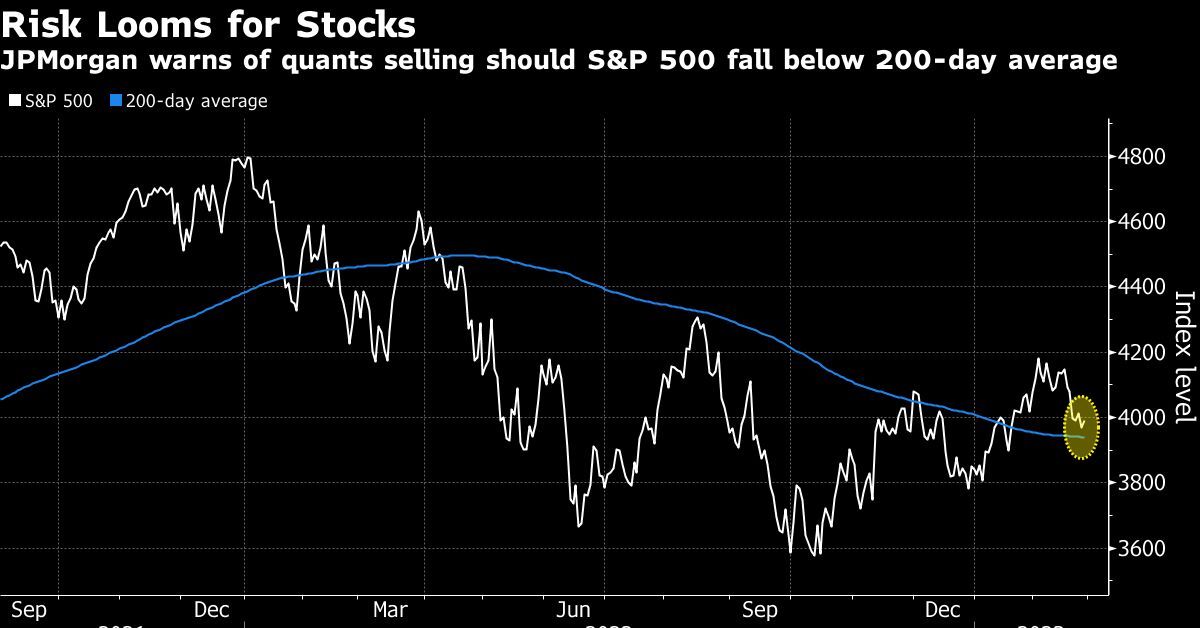

After helping to fuel the significant rally on Wall Street, trend-following quantitative investors now appear set to sell equities if the S&P 500 goes below an important technical mark, according to the trading desk at JPMorgan Chase & Co.

According to the estimations made by the JPMorgan team, so-called commodities trading advisors may be required to offload approximately $50 billion worth of equity holdings if the benchmark gauge falls below its average price from the previous 200 trading days. On Friday, the index was only 1% away from the critical level, which was located close to 3,940.

According to Nomura Securities International, the amount of money that CTAs have withdrawn from global stock markets in the past two weeks already totals $40 billion. Further selling would make this withdrawal much more significant. CTAs were among the quant players that contributed to the stock rally that began in October but turned into sellers in 2023, which dampened the market’s new-year surge. This occurred after CTAs were among the quant players that helped spark the rally.

It is not simple to obtain a clear image of the world of quantitative analysis, and models that are constructed on subjective assumptions frequently produce varying numbers regarding money flows. Such projections provide a window into the positioning of fast-money traders, a technical force that Wall Street is becoming increasingly fixated on in a market where fundamental narratives are constantly shifting. While this is by no means an exact science, such projections do offer some insight into the positioning of fast-money traders.

During the course of the previous year, CTAs increased their exposure to the inflation trade as the Federal Reserve hurried to raise interest rates and tighten financial conditions. The group as a whole wagered for a stronger dollar and bet against bonds and stocks, which at times amplified the movements of assets. Charlie McElligott, a cross-asset strategist at Nomura, believes that the group’s significance cannot be disregarded despite the fact that the current direction in macroeconomics is less clear-cut.

McElligott told Bloomberg TV-

“Now you are looking at this transitory phase where you’re going to have this range trade where dollar softens, risk assets rally, FCI eases too much, data picks back up, the Fed has to talk hawkishly again”

“It’s making it a very tactical market. That’s further impacting those flows that can truly push around the market when there’s so little conviction from the fundamental types.”

More Finance News:

- Stocks Moving After The Market Closes: Zoom, Occidental Petroleum, Workday

- Gold Hits A Two-month Low After U.S. Data Raises Fears Of A Rate Hike

On Monday, stock prices increased, and the S&P 500 was on track to finish above its 200-day moving average for the 26th consecutive trading session. This is the longest stretch of buoyancy seen in the market since January 2022. The rebound came after a rough week, during which the index suffered its worst weekly performance of the entire year, falling 2.7%.

The stock market had a solid start to the new year with a rise on the back of rumors that the Federal Reserve may reduce interest rates later this year. Traders have changed their rate expectations in response to a flurry of news that was higher than expected on the employment market and inflation, which has resulted in a decrease across a variety of assets.

During the surge in January, quantitative traders were pressured to unwind their negative wagers, a move that has resulted in their positions becoming more vulnerable to a decline in price. According to an estimate provided by the trading desk at Morgan Stanley, systemic trading techniques would be compelled to unload $55 billion to $60 billion worth of shares during the following week if the market continued to drop by around 5%. A market decline of the same magnitude a month ago would have resulted in the sale of between $10 billion and $15 billion worth of stocks.

“The systematic bid will continue, but at a much slower pace and with a lower bar to turn into supply,” Morgan Stanley’s team wrote in a note late Friday.

If you enjoyed reading this post, please share your feedback with us in the comments box below. In addition, don’t forget to check back on our website Journalist PR for updates on the most recent financial news.

Leave a Reply