According to a letter from the bank that cited data from EPFR Global, global equities funds experienced outflows totaling $7 billion during the week ending February 22, while cash funds experienced outflows totaling $3.8 billion. According to the team led by Michael Hartnett, bond purchases increased for the eighth consecutive week, reaching a total of $4.9 billion. This is the longest such sequence since November 2021.

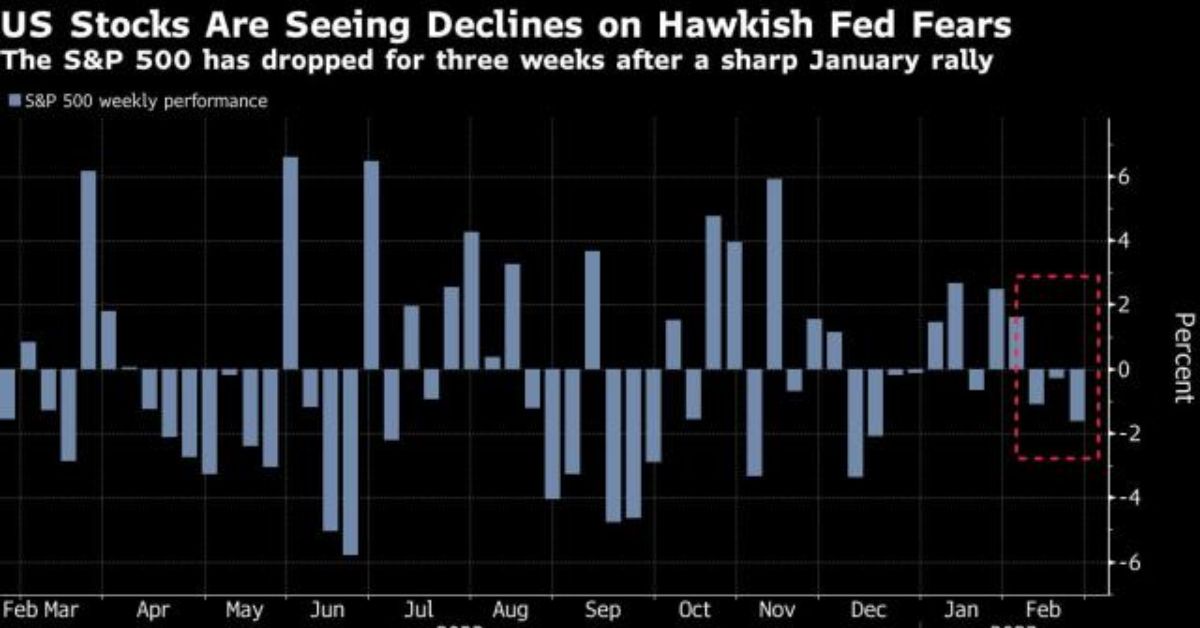

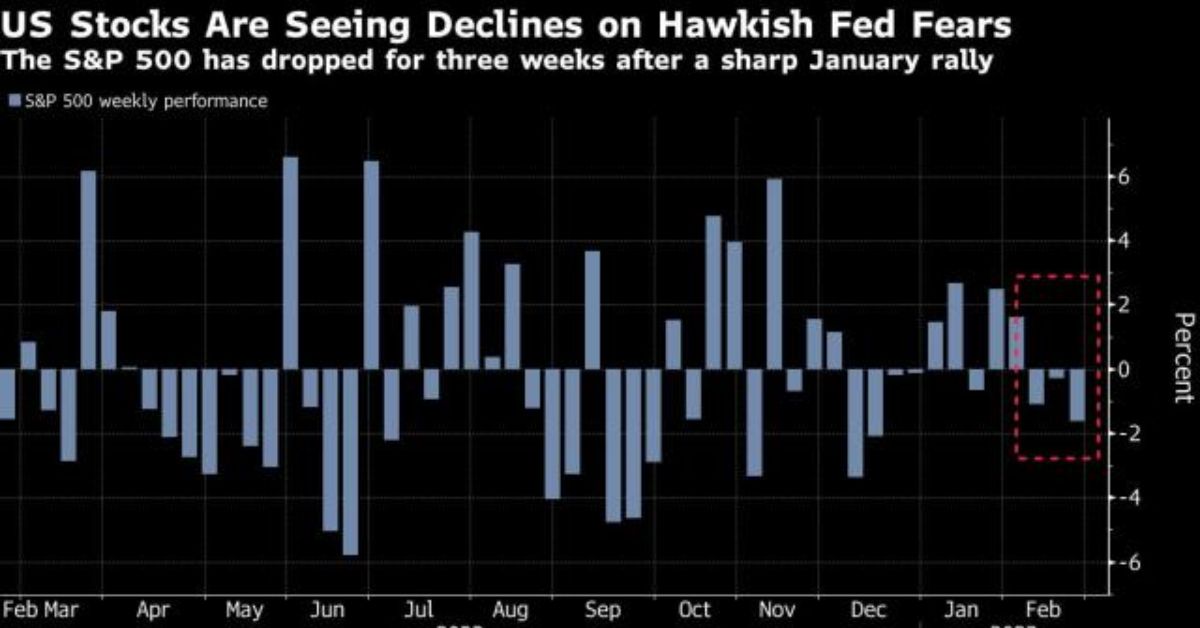

The stock market in the United States has experienced a decline over the past three weeks as a result of growing concerns that the Federal Reserve may maintain higher interest rates for a longer period of time.

The Federal Reserve’s preferred inflation gauges revealed an acceleration in January that was greater than expected, and consumer spending climbed by the highest since 2021, according to figures that were released on Friday. With the release of the report, US stock futures continued their downward trend.

Risk appetite has also been dampened as a result of the first quarterly dip in corporate earnings since 2020. Market experts on Wall Street, such as Michael Wilson at Morgan Stanley, have issued warnings that equities may experience significant declines over the next few months.

The analyst Hartnett from Bank of America stated once again that he believes the S&P 500 will fall below 3,800 points by March 8; this would imply declines of more than 5% from its most recent closing price. The prediction made by the strategist is based on the anticipation that robust growth in the first half of the year would coincide with rising interest rates, which will then lead to a more significant downturn in economic activity in the second half of the year.

On Friday, strategists working for Citigroup Inc. shared the view that a recession in the United States is eventually likely. Contrary to the pattern seen more generally, private clients of BofA have made the most significant stock purchases in the past eight weeks.

In terms of geography, emerging-market stock funds saw net inflows of $2.1 billion during the week, while US equities saw redemptions of $9 billion for the third week in a row. Moreover, redemptions from European funds started back up again.

When broken down by investment strategy, money flowed into US value and small size funds, while growth and large cap funds witnessed outflows. The energy industry led the way for sectoral investments, while the materials and finance sectors witnessed the largest outflows.

If you found value in the information presented here, please share your feedback with us in the comments area. In addition, don’t forget to check back on our website Journalist PR for updates on the most recent financial news.

Leave a Reply